My Investments Update – January 2024

Happy New Year! Here is my latest monthly update about my investments. You can read my December 2023 Investments Update here if you like

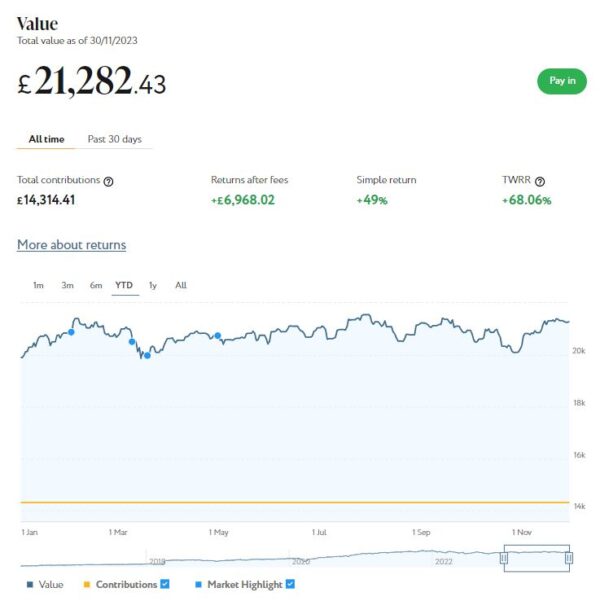

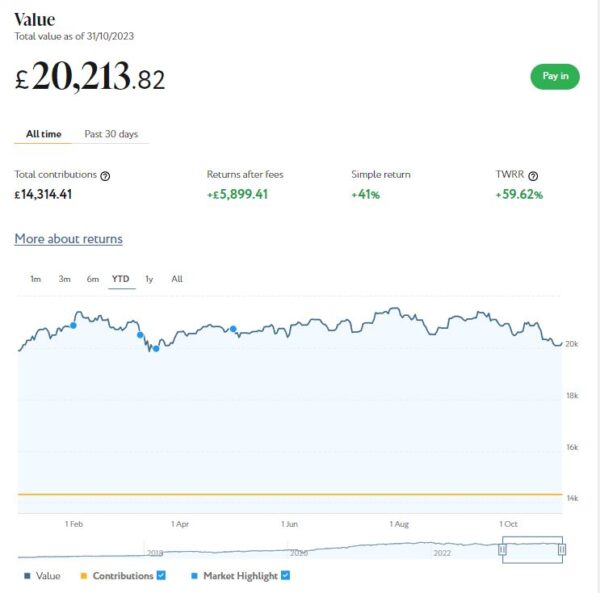

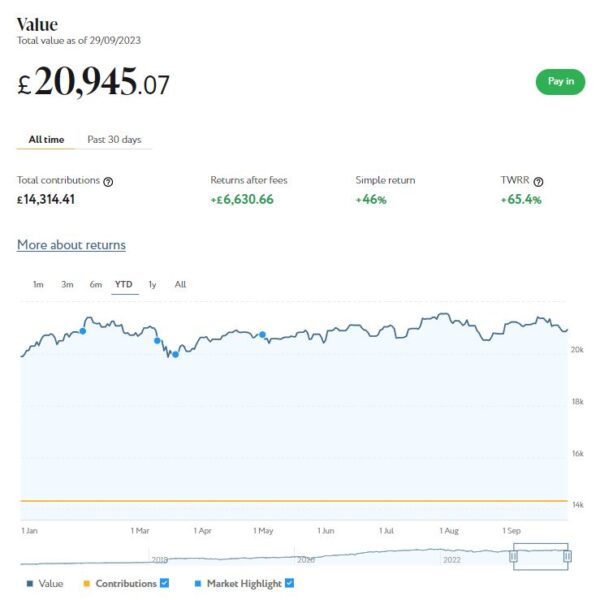

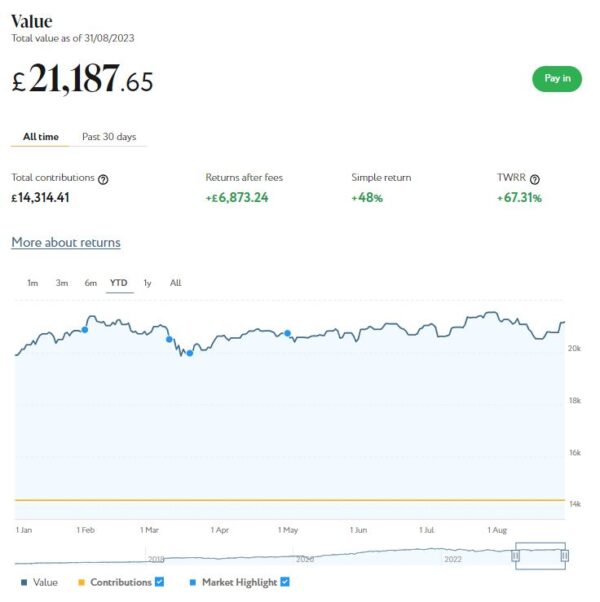

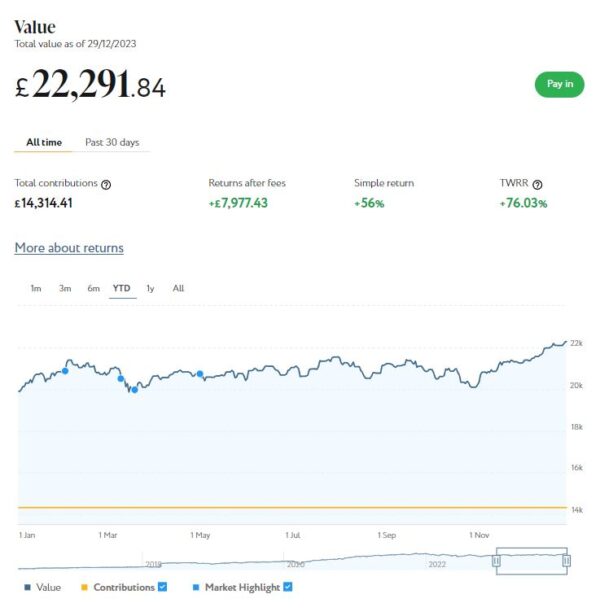

I’ll begin as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension).

As the screenshot below for the year to date shows, my main Nutmeg portfolio is currently valued at £22,292. Last month it stood at £21,282 so that is an increase of £1,010.

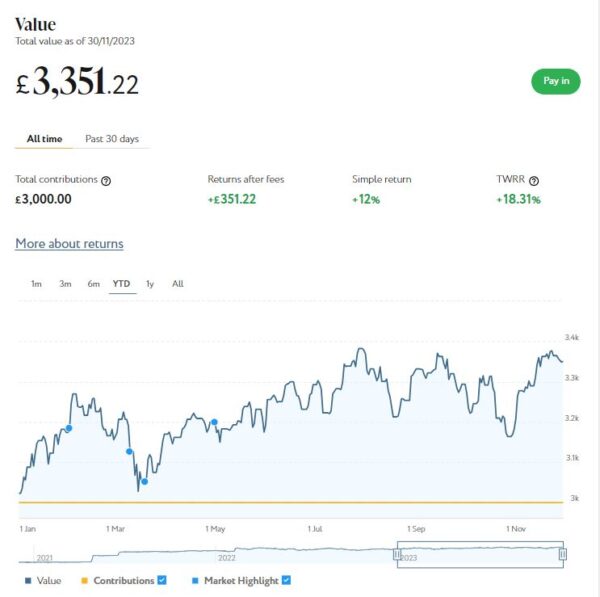

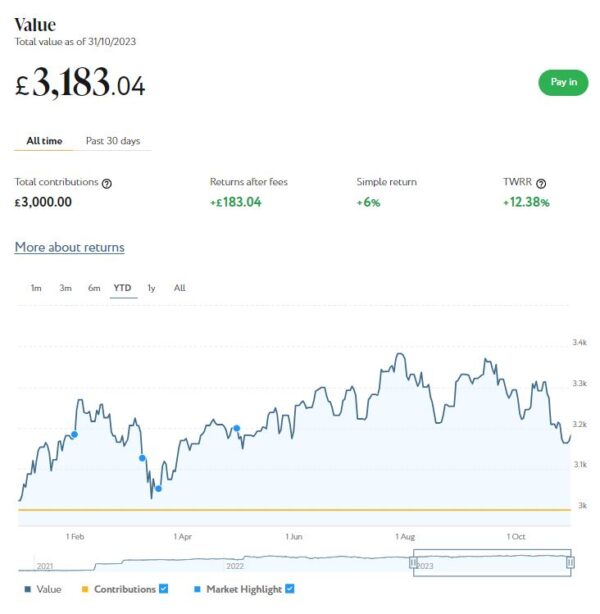

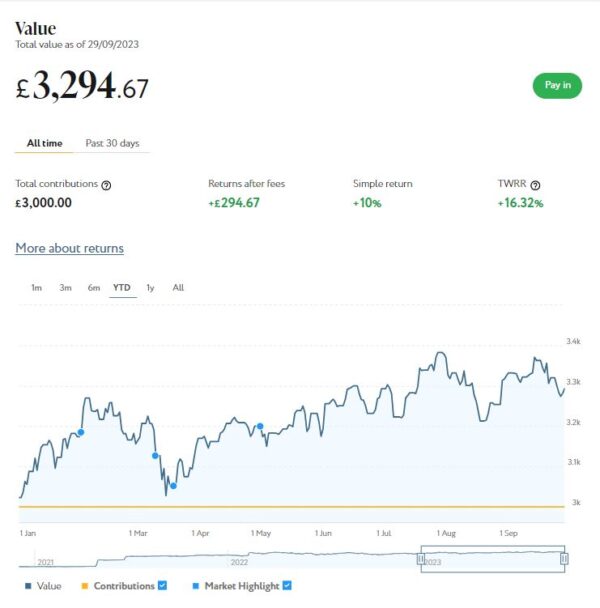

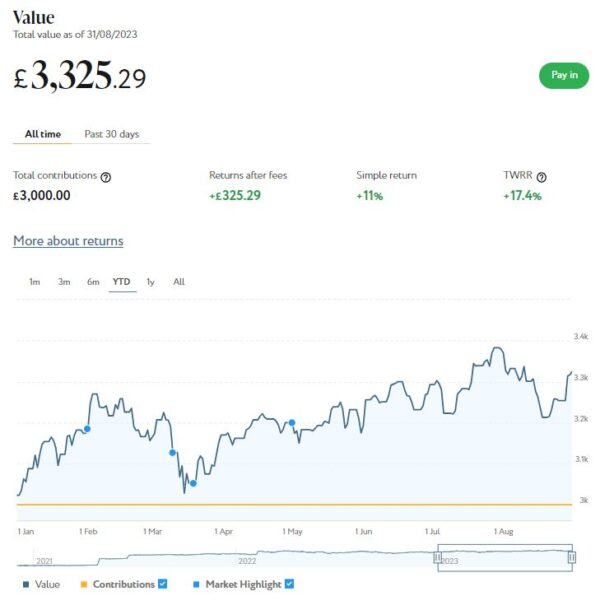

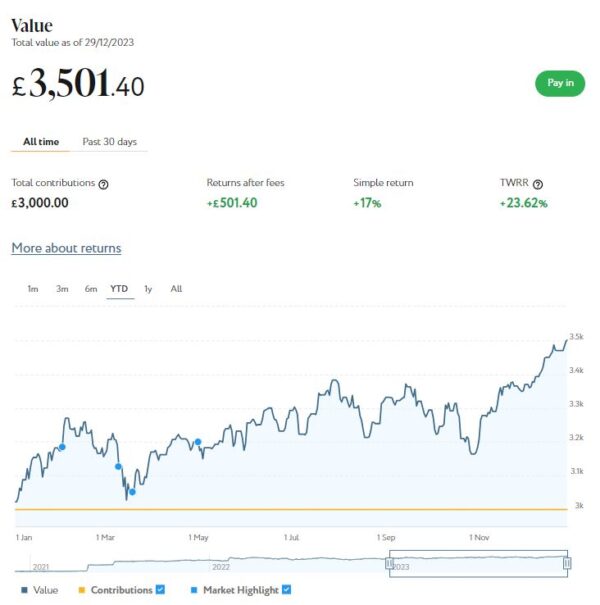

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,501 compared with £3,351 a month ago, a rise of £150. Here is a screen capture showing performance since the start of this year.

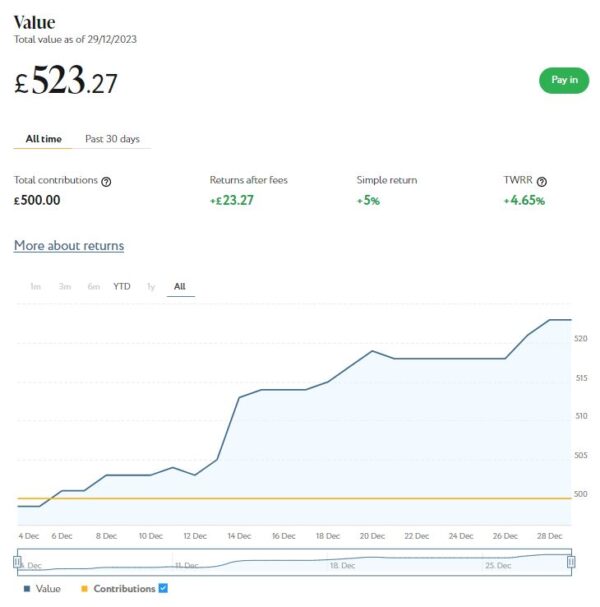

Finally, at the start of December I invested £500 in one of Nutmeg’s new thematic portfolios (discussed further below). This has now grown to £523, an increase of £23 or 4.6%. That would equate to an annual interest rate of just over 55%. Naturally I don’t expect that to happen in reality!

December was obviously another very good month for my Nutmeg investments. Excluding my new thematic portfolio, their total net value rose by £1,160 or 4.71% month on month. That represents an increase of £2,872 (12.53%) since 1st January 2023. If you add in the increase in value of my thematic portfolio as well (£23), that gives a total increase of £2,895 since the start of the year.

This is obviously a much more positive outcome than appeared likely just a few months ago. It clearly demonstrates the importance of taking a long-time view where investing is concerned and not panicking when the inevitable downturns occur.

As regards thematic portfolios, I discuss these in more detail in my full Nutmeg review. Personally I opted for Resource Transformation. Nutmeg’s description of this portfolio is copied below:

As the global population has risen, so has our demand for energy and resources. In recent years, the way we use resources has also shifted to meet changing consumer demands and national policy shifts towards a lower carbon future.

This theme aims to provide exposure to companies that will participate in these changes and service our energy and material needs in the future. This includes the next generation of energy production, which includes renewables and non-renewables, the mining of metals and materials needed for mass-market electrification, and the treatment and transportation of water.

This appealed to me for various reasons. Clearly energy production will be crucial in the coming decades as the world attempts to transition away from fossil fuels. But I also like the fact that the portfolio includes both renewable and non-renewable energy providers. Realistically we are still going to require fossil fuels for many years, not least to keep the lights on when the wind doesn’t blow and the sun doesn’t shine.

The Resource Transformation portfolio offers plenty of diversification, with all investments in the form of ETFs (exchange traded funds). In addition, only a maximum of 20% of your investment will be in ETFs specific to the theme, with the other 80% more broadly diversified. Actual percentages depend on the risk level you choose. I went for the highest (10/10), so 20% of my investment will be in RT-themed ETFs. But if I’d opted for a lower risk level the proportion of my investment dedicated specifically to the theme would have been less (down to 10% for the lowest risk level, which is 5 for thematic portfolios).

If you are new to thematic investing and want to dip a toe in the water, it does seem to me that Nutmeg thematic investments could be a good, relatively low risk way of doing so, with plenty of diversification. Though of course there are never any guarantees where investing is concerned and you can always lose money when doing this.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your annual ISA allowance, based on my overall experience over the last seven years, they are certainly worth considering. They offer self-invested personal pensions (SIPPs), Lifetime ISAs and Junior ISAs as well.

I also have investments with the property crowdlending platform Kuflink. They continue to do well, with new projects launching every week. I currently have around £1,600 invested with them in 10 different projects paying interest rates averaging around 7%. I also have around £300 in my Kuflink cash account, after a couple of other loans were paid off with interest. I will probably withdraw this to help pay for a holiday in 2024 🙂

To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question.

There is now an initial minimum investment of £1,000 and a minimum investment per project of £500. Kuflink say they are doing this to streamline their operation and minimize costs. I can understand that, though it does mean that the option to test the water with a small first investment has been removed. It also makes it harder for small investors (like myself) to build a well-diversified portfolio on a limited budget.

One possible way around this is to invest using Kuflink’s Auto/IFISA facility. Your money here is automatically invested across a basket of loans over a period from one to three years. Interest rates currently range from 7% for one year to 9.83% gross for a three-year term.

You can invest tax-free in a Kuflink Auto IFISA. Or if you have already used your annual iFISA allowance elsewhere, you can invest via a taxable Auto account. You can read my full Kuflink review here if you wish.

Moving on, my Assetz Exchange investments continue to generate steady returns. Regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated a respectable £155.08 in revenue from rental income. As I said in last month’s update, capital growth has slowed, though, in line with UK property values generally.

At the time of writing, 7 of ‘my’ properties are showing gains, 1 is breaking even, and the remaining 19 are showing losses. My portfolio is currently showing a net decrease in value of £42.61, meaning that overall (rental income minus capital value decrease) I am up by £112.47. That’s still a decent return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio. And it doesn’t hurt that with Assetz Exchange most projects are socially beneficial as well.

- As mentioned last time, I recently reinvested £40 of my rental income from Assetz Exchange in a house for asylum seekers in Sunderland. This property is being managed by Mears on behalf of the Home Office, so I think the chances of them going into default are pretty remote! My £40 investment in this property has already increased in value by 54p and I have received 22p in revenue. It all helps 🙂

The overall fall in capital value of my AE investments is obviously a little disappointing. But it’s important to remember that until/unless I choose to sell the investments in question, it is largely theoretical, based on the most recent price at which shares in the property concerned have changed hands. The rental income, on the other hand, is real money (which in my case I’ve reinvested in other AE projects to further diversify my portfolio).

To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned (especially now that Kuflink have raised their minimum investment per project to £500). You can actually invest from as little as 80p per property if you really want to proceed cautiously.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

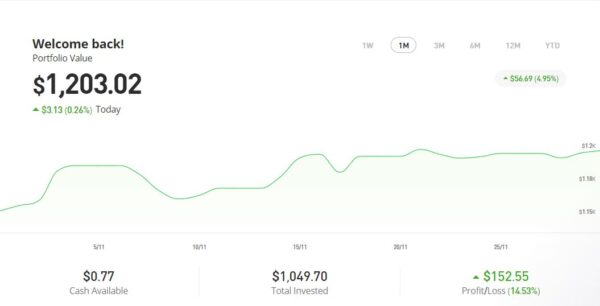

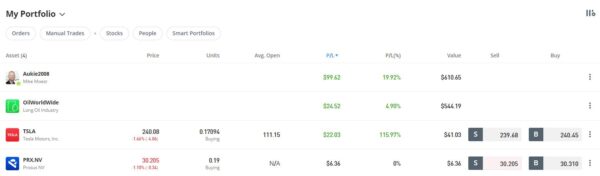

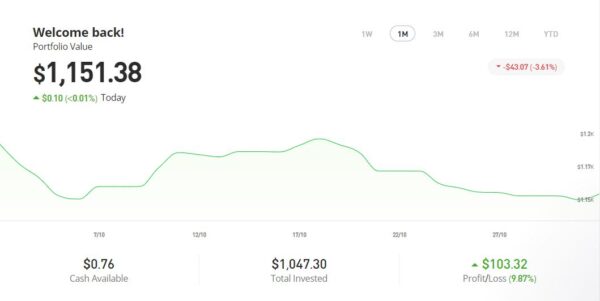

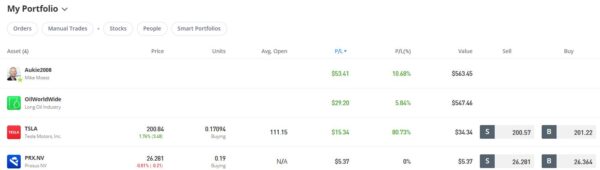

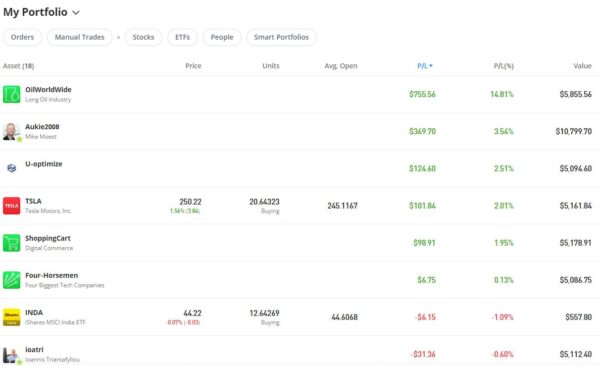

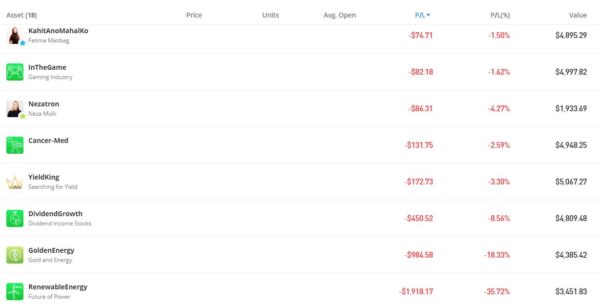

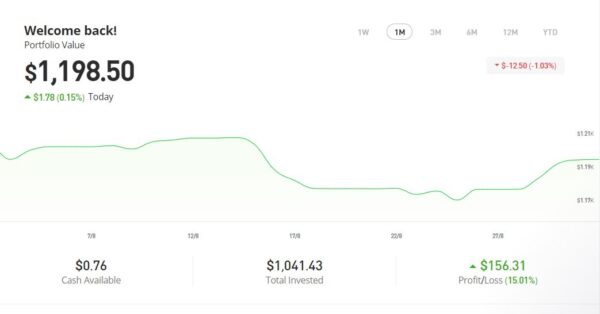

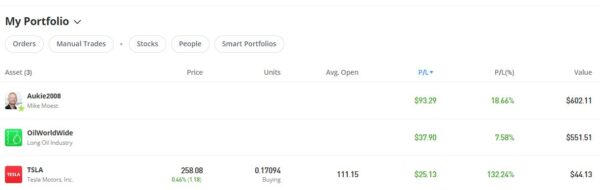

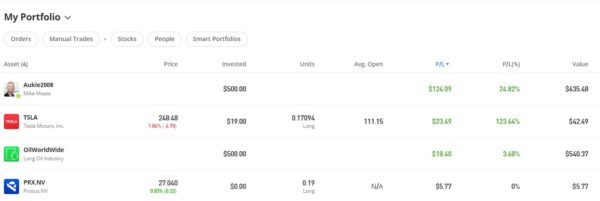

Last year I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie2008 (real name Mike Moest).

In January 2023 I added to this with another $500 investment in one of their thematic portfolios, Oil Worldwide. I also invested a small amount I had left over in Tesla shares.

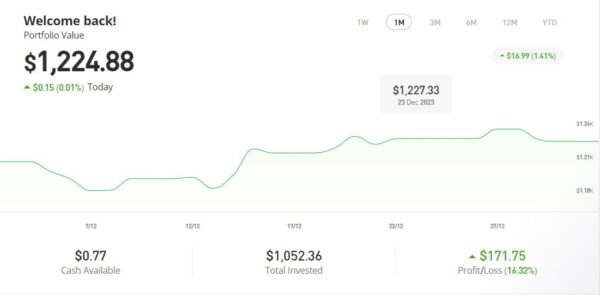

As you can see from the screen captures below, my original investment totalling $1,022.26 is today worth $1,224.88, an overall increase of $202.62 or 19.82%. In these turbulent times I am very happy with that.

You can read my full review of eToro here. You may also like to check out my more in-depth look at eToro copy trading. I also discussed thematic investing with eToro using Smart Portfolios in this recent post. The latter also reveals why I took the somewhat contrarian step of choosing the oil industry for my first thematic investment with them.

- eToro also recently introduced the eToro Money app. This allows you to deposit money to your eToro account without paying any currency conversion fees, saving you up to £5 for every £1,000 you deposit. You can also use the app to withdraw funds from your eToro account instantly to your bank account. I tried this myself and was impressed with how quickly and seamlessly it worked. You can read my blog post about eToro Money here.

I had two more articles published in December on the excellent Mouthy Money website. The first is How to Make Money Teaching English Online. As I say in the article, this can be an excellent home-based money-making opportunity which offers great personal satisfaction as well. Prior teaching experience isn’t necessarily required, though if you have some it will certainly help.

Also in December Mouthy Money published my Christmas Gift Guide for Older People. Obviously Christmas has now passed. But if you are looking for gift ideas for older friends and relatives (maybe for birthdays or anniversaries) you may still find this a good source of inspiration 🙂

As I’ve said before, Mouthy Money is a great resource for anyone interested in money-making and money-saving. I particularly like the ‘Deals of the Week’ feature compiled by Jordon Cox (‘Britain’s Coupon Kid’) which lists all the best current money-saving offers for savvy shoppers. Check out the latest edition here.

Mouthy Money are also currently running a competition to win one of five free copies of Freedom: Earn It, Keep It, Grow It by Robert Gardner (see Amazon image link below). Visit this page of the Mouthy Money website for further info and to enter.

I also published several posts on Pounds and Sense in December. I won’t bother mentioning those that are out of date now, but the others are listed below.

I guess My Top 20 Posts of 2023 is self-explanatory. The posts are chosen based on comments, page-views and social media shares. They are in no particular order and I excluded any that were no longer relevant. I hope you may enjoy revisiting these posts, or seeing them for the first time if you are new to PAS.

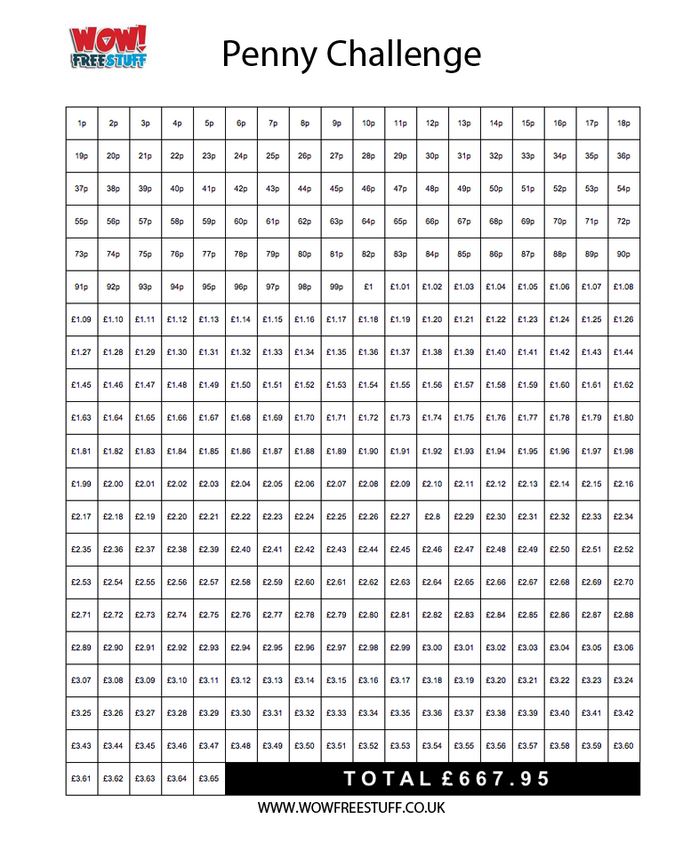

The other post was Take The Penny Challenge to Save £667.95 by This Time Next Year! This post sets out a clever, relatively painless way to save up a useful sum by the end of 2024. Do check it out!

On other matters, the opportunity to get a free share worth up to £100 with Trading 212 has reopened. If you haven’t done this before, you can get a free share worth up to £100. You just have to sign up on the website and deposit a minimum of £1 into your account. This offer is running till 27 January 2024. See Get a Free Share Worth up to £100 with Trading 212 for more info.

You can also still Get a Free ETF Share Worth up to £200 with Wealthyhood. This DIY wealth-building app is aimed especially at people new to stock market investing. The minimum investment to qualify for the free share offer is £50 – but on the plus side, they now guarantee your free ETF share will be worth at least £10.

I wanted to mention as well that I am still using and getting good results from the cashback app JamDoughnut. You can see my review of JamDoughnut here, along with a referral code that will get you a £2 bonus when you sign up. To be honest I’m a bit surprised more PAS readers haven’t taken advantage of this opportunity. Not only can you get discounts of up to 20% using the app, they also hold regular contests and promotions offering additional bonuses and discounts.

Finally, a quick reminder that you can also follow Pounds and Sense on Facebook or Twitter/X. Twitter/X is my number one social media platform these days and I post regularly there. I share the latest news and information on financial (and other) matters, and other things that interest, amuse or concern me. So if you aren’t following my PAS account, you are definitely missing out!

That’s all for today, so I will close by wishing you a very happy and prosperous new year. As always, if you have any comments or queries, feel free to leave them below. I am always delighted to hear from PAS readers