New Survey Sheds Light on Britons’ Investing Habits

Today I am sharing some interesting data from my friends at HSBC regarding British people’s investing habits.

This information comes from a survey conducted last year by Sticky and Censuswide on behalf of HSBC. The survey was conducted online, with a total sample size of 2018 adults. It reveals how and why people in the UK are investing, and (very importantly) why many are not.

The research revealed that nearly two-thirds of people had some form of savings (64%), with more than one in three (36%) saying they had investments. Nearly half (47%) believed investing was a better way of achieving future financial goals in the current financial climate.

More than half of people (53%) who said they would like to invest but haven’t yet said they didn’t know how to begin. Just over 1 in 3 Brits are currently investing, so almost two-thirds are not.

Saving vs Investing

Somewhat reassuringly, two-thirds of people in the survey said they currently have savings (64%) and just under three-quarters (72%) said they have enough money put away to cover three months’ living expenses despite increases in the cost of living.

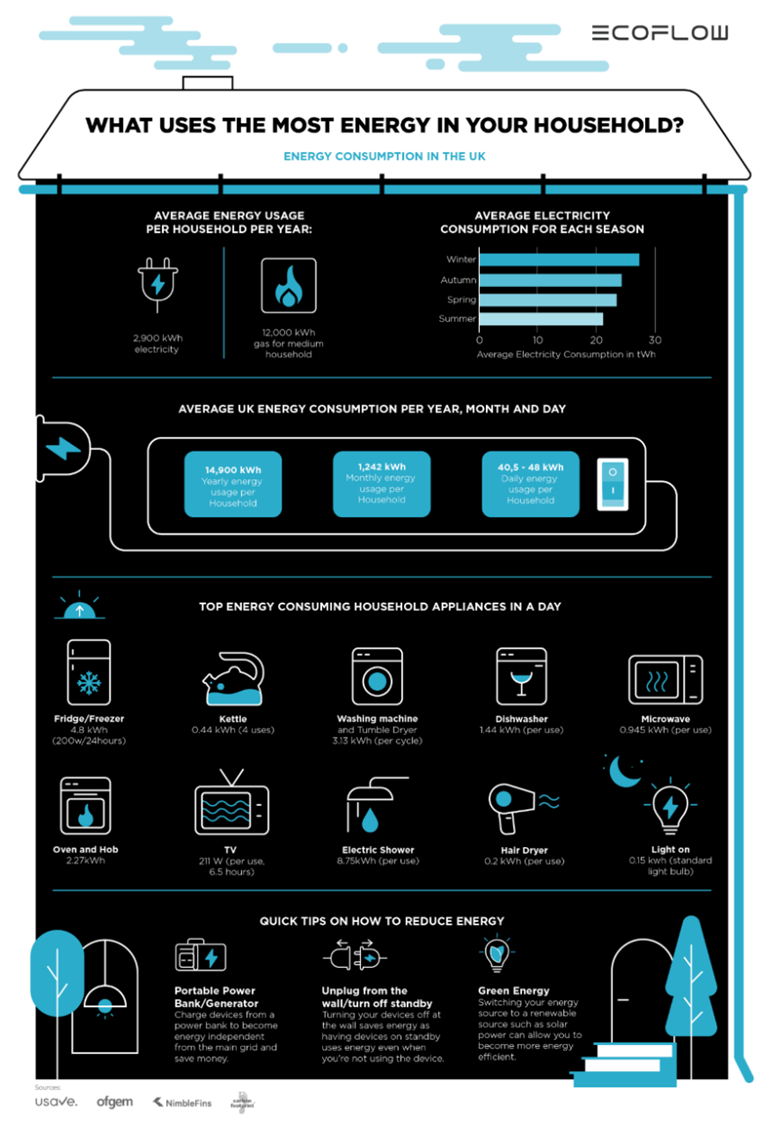

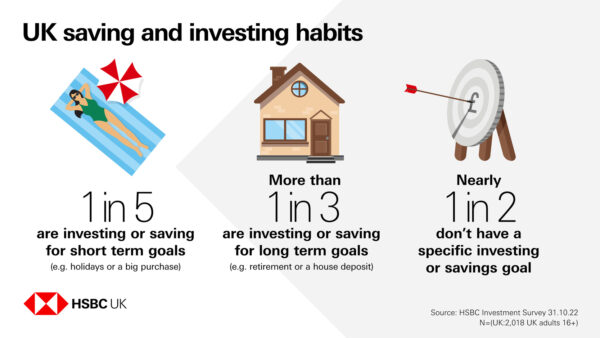

The main reasons people have for saving and investing are summed up in the infographic below…

As you can see, nearly half of people in the HSBC survey (46%) didn’t have a particular goal for their saving or investing – but those who did have a target were much more likely to be saving for something long-term (37%) like a house deposit or their retirement than short-term goals like holidays or other large purchases (20%).

In general, of course, saving for short-term goals is best done through cash savings accounts – but for long-term goals, typically five years or more ahead, investing is likely to produce better overall returns.

Investment Choices

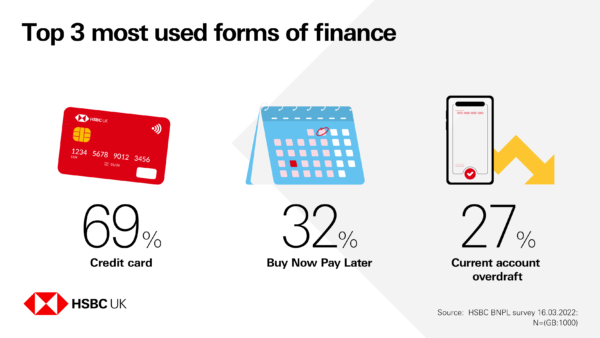

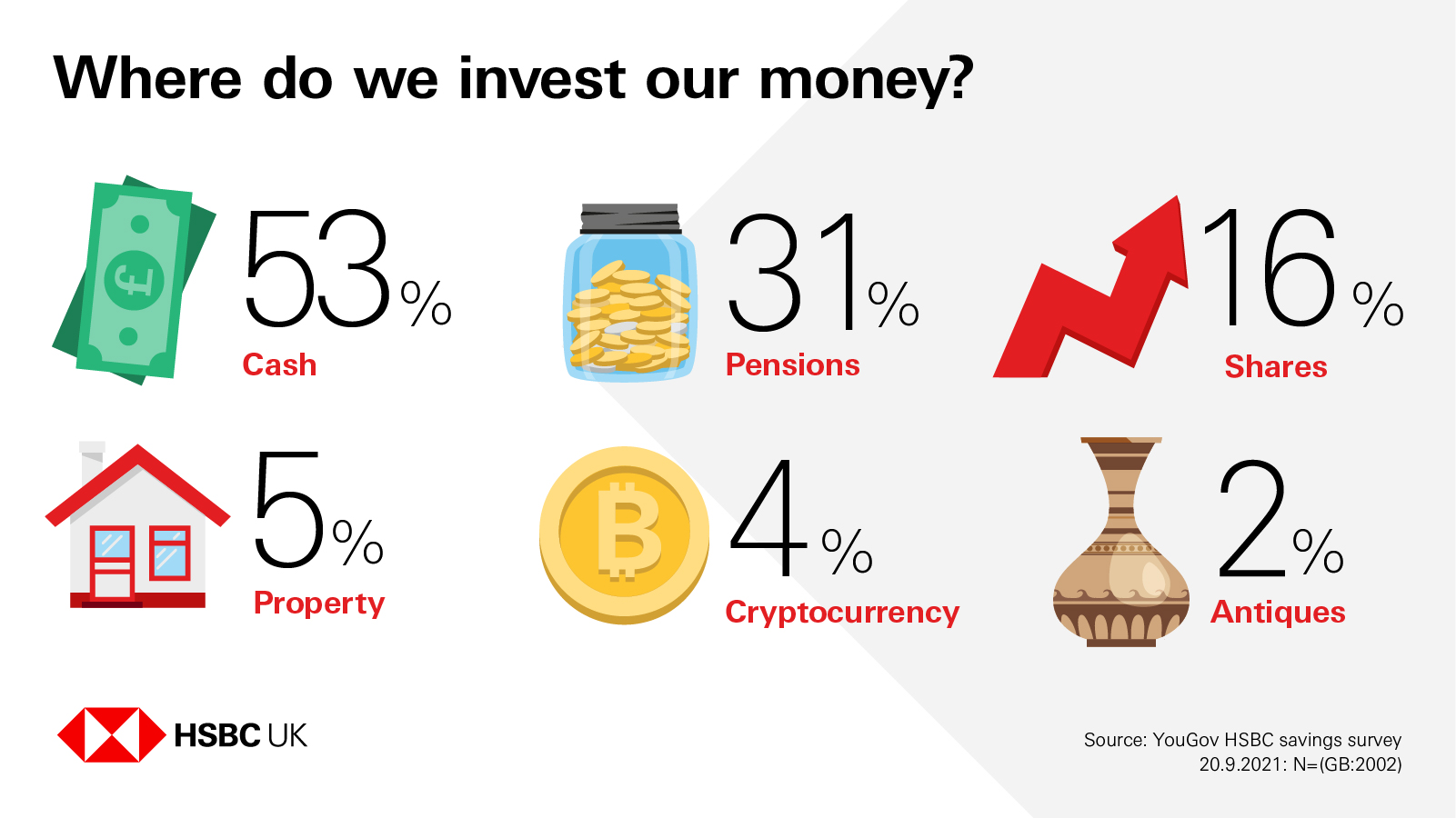

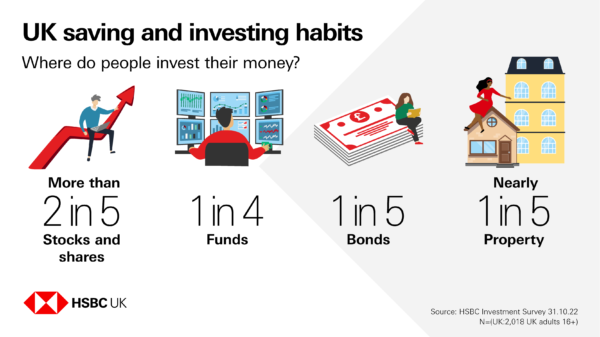

The infographic below shows the main ways people in the UK are currently investing.

As you can see, the most popular investment is stocks and shares (44%), followed by funds (25%), bonds (20%) and property (19%).

When people were asked how they’d decided to invest, the most common reason given for choosing stocks and shares was the expectation of good returns (34%). Bonds were most often seen as a “safe” investment (38%).

Meanwhile, the reason for choosing funds was more equally balanced between being seen as offering good returns (34%) and being “safe” (30%), with the same being true of property (39% good return, 35% “safe”).

Barriers to Investing

When people were asked why they hadn’t chosen to invest, the most common answer (45%) was thinking they didn’t have enough money to do so. But nearly a quarter (23%) said they didn’t know enough about how to invest, ahead of the one in five (21%) who said they would worry about losing all their money.

For those who said they were scared of losing money, the main driver of those worries was the fact that investments can go down as well as up (40%). But that was followed by concerns about the need for access to their cash – with 37% saying they might need their money at short notice, and another 30% stating that their financial situation meant they couldn’t lock away money for a long time.

Those who chose to invest in jewellery and alternatives (wine, art, whisky, etc) were the most likely to say they had done so because they had expertise in that area (25%).

Investment Knowledge

When it comes to detailed financial knowledge, more than one in three (34%) said they didn’t feel they had enough information about investing. And those who wanted more help with their financial planning were most likely to need information about where to invest (25%), followed by support on types of investments (22%), the cost of investing (20%), and which investments are more or less risky (20%).

People who said they already received some information on investing were most likely to get that from their family (17%), their bank (16%), friends (15%) and social media (15%) – all ahead of financial newspapers (13%) and financial blogs (11%).

Nearly a quarter (24%) said they’d like to receive more information about investing from their bank as the primary source of information, ahead of getting help from investors (16%), social media (13%), family (11%) and financial blogs (11%) or financial newspapers (11%).

My Thoughts

Many thanks to my friends from HSBC for allowing me to share and discuss their data and graphics.

I’m not surprised that many people are wary of investing, as the subject isn’t generally taught in schools and the huge number and variety of potential investments can be bewildering.

What I find a little more surprising (and concerning) is that many more people have investments in the form of stocks and shares (46%) rather than funds (25%). I suspect this may partly be to do with people having a few shares they acquired from the big privatizations of the past such as BT and British Gas. There may also be a number who have shares through employee share schemes. Nonetheless – as I said in this recent guest post for the popular Money Talk blog – as an investment individual shares are a lot more volatile and risky. If you are new to investing, I highly recommend starting off with a collective investment such as a tracker fund or robo-adviser platform (see below). This will give you much broader diversification, which helps mitigate the risks involved.

As I’ve said before, if you suddenly find yourself in possession of a large lump sum (perhaps through an inheritance) there is a strong case for seeking advice from a trained and experienced independent financial adviser. You might like to check out my blog post on why, despite being a money blogger and considering myself reasonably financially savvy, I still have an IFA myself.

If you just want to get started in investing, there are various low-cost and relatively low-risk options you could consider. Regular readers will know that I am a fan of the robo-adviser platform Nutmeg, with whom I have been investing since 2016. Even with the recent turmoil in the markets caused by the pandemic etc., I have made an overall return of 37 percent from my investments with them. You can read my in-depth review of Nutmeg here if you wish.

Another possibility might be the wealth-building platform Wealthyhood, which is aimed especially at novice investors. You can get started on this with as little as £20 – and right now they are offering a free ETF share worth up to £200 to new investors, which should get you off to a good start! You can see my blog post about Wealthyhood and their special offer here.

Of course, all investing carries a risk of loss, in the short- to medium-term especially. You should therefore always do your own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed.

As always, if you have any comments or questions about this post, please do leave them below.

Disclaimer: I am not a professional financial adviser and nothing in this post should be construed as personal financial advice.