Bricklane: My Review of This Property Investment Platform

Please be aware that this is a historical post. Bricklane is now closed to new investors and is winding down. Please see the comments below for the latest updates about it.

Today I am looking at another property investment platform, Bricklane.

Unlike Kuflink and Ratesetter, both of which I have discussed previously on this blog, Bricklane is not a platform for peer-to-peer loans. Neither does it arrange crowdfunded investments in specific properties like Crowdlords and Property Partner.

Bricklane is structured as a Real Estate Investment Trust, or REIT for short. For those who don’t know, REITs are property funds that use investors’ money to buy (and manage) property and provide returns in the form of rental income plus capital appreciation.

In order to qualify as a REIT in the UK, companies have to meet certain requirements. The most important are as follows:

- At least 75% of their profits must come from property rental.

- At least 75% of the company’s assets must be involved in the property rental business.

- They must pay out 90% of their rental income to investors.

In exchange for operating within these rules – and to encourage investment in UK real estate – REITs are not required to pay corporation or capital gains tax on their property investments. That helps make REITs profitable for the companies running them, and is how they are able to generate attractive returns for investors.

Normally rental income from REITs is treated as taxable income and taxed at your highest marginal rate. However, if you invest through an ISA or SIPP (Self Invested Personal Pension) no tax is due. You therefore get the best of both worlds – your money isn’t subject to taxation while invested in the REIT, and when it comes back to you in the form of income distributions and profits on sales of shares, you don’t have to pay tax on these either.

Types of Investment

You can invest in Bricklane as a stocks and shares ISA or a SIPP, or failing that in a standard investment account, where you will be liable for tax.

To maximize the benefits from investing in a REIT, I highly recommend going down the SIPP or ISA route, if you haven’t already used up this year’s allowance. As a reminder, everyone has a £20,000 annual ISA allowance (for 2019/20) and you are also only allowed to invest in one cash ISA, one stocks and shares ISA and one Innovative Finance ISA (IFISA) in any one tax year. I invested in a stocks and shares ISA with Bricklane myself.

Bricklane has two property portfolios you can invest in. These are Regional Capitals, which includes properties in Birmingham, Manchester and Leeds. and London, with a portfolio of properties in the capital. The Regional Capitals portfolio has generated a return of 19.3% since it was launched in September 2016 and the London portfolio 8.9% since its launch in July 2017 (figures from the Bricklane website).

As a Bricklane investor, you can choose to invest in either or both portfolios, in any proportion you choose. I opted to put all my money into Regional Capitals, as I believe this is where the biggest growth potential lies. In addition, rental income in this portfolio is higher, and I am also concerned about the possible impact of Brexit on London. You might see this differently, of course!

Bricklane Pros and Cons

Based on my experiences so far – and some online research – here is my list of pros and cons for the Bricklane property investment platform.

Pros

1. Fast, easy sign-up.

2. Well-designed, intuitive website.

3. Low minimum investment of £100.

4. Bricklane take care of all the work involved in buying and managing properties. You just choose which portfolio/s to invest in.

5. REIT structure offers significant tax advantages.

6. Tax-free ISA and SIPP options are available.

7. Possibility to access your money at any time (though this does depend on another investor being willing to buy your shares).

8. Customer service (in my experience anyway) is fast, friendly and helpful.

9. Charges are reasonable, comprising an initial 2% fee (though see my comment below on how you may be able to offset this) and 0.85% annual management fee.

10. Potential to profit through both capital appreciation and rental income.

11. Rental income is paid into your account every three months. You can either withdraw it or reinvest it to compound your returns.

12. Up to £1,500 cashback is available for new investors of £5,000 or more via my referral link (see below).

Cons

1. No detailed information provided about the properties your money is invested in.

2. Can’t invest in an ISA if you have already put money into another stocks and shares ISA this year.

3. 20% tax deduction from rental income at source if you don’t invest via a SIPP or ISA (and additional liability if you are a higher rate taxpayer).

4. Minimum £10,000 investment for a SIPP.

5. Returns over the last few months have been disappointing (see below)

6. No absolute guarantee you will be able to sell your shares when the time comes.

My Experiences

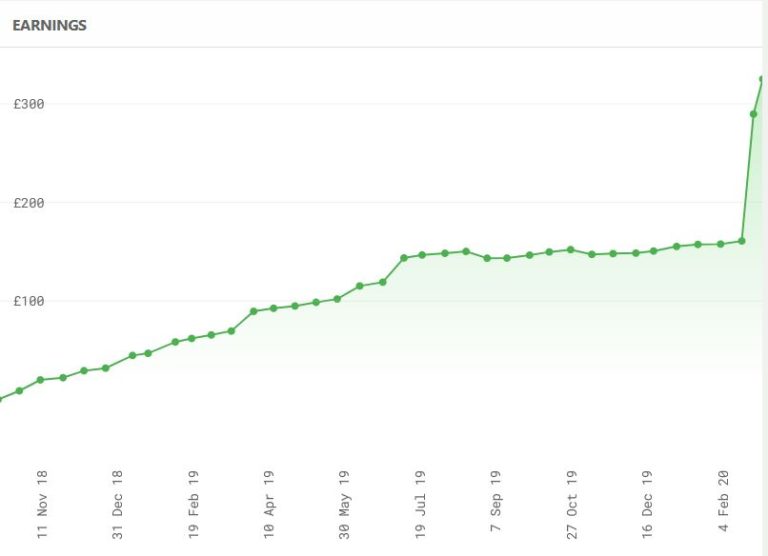

I put £5,000 into a Bricklane Stocks and Shares ISA in October 2018. As mentioned above, I chose to invest in the Regional Capitals rather than the London portfolio. The graph below – taken from my member’s page – shows the earnings generated since I opened my account.

As you will see, initially my investment performed pretty well. In the first nine months I made about £150, which equates to an annual interest rate of 4% (tax-free). That’s not spectacular, but it still beats most bank and building society accounts by a considerable margin. It is similar to the top rate currently on offer with P2P platform RateSetter in their Max account, although in their case you have to pay a fee equivalent to 90 days’ interest if you wish to withdraw. There is no withdrawal fee with Bricklane.

Since July/August 2019, however, returns have diminished considerably. My earnings between August 2019 and February 2020 were only just over £7, which is clearly a very low percentage rate. Of course, a large part of this is down to the depressed state of the property market caused by uncertainty over Brexit. I am hoping that now this is definitely happening – for better or for worse – my investment will get back on an upward trajectory again. Although recent results have been disappointing, at least the overall value of my portfolio hasn’t gone down (which has happened with some of my other property-related investments).

One other thing I should mention is that in October 2019 I withdrew £1,000 from my account to help fund a new central heating boiler after the old one packed in. This has therefore also reduced my returns a little. Although even if I still had the full £5,000 invested, earnings over the last few months would still have been nothing to write home about.

- I should add that the withdrawal in question proved straightforward, although it wasn’t instant. I received the money in my bank account about a fortnight after putting in my request.

Conclusion

Clearly the performance of my Bricklane portfolio since last August has been disappointing, though overall I am still better off than I would have been if I had kept my money in a bank or building society.

I am hoping that things will start to improve in the property markets now that the Brexit issue has been resolved. There are some signs of this, although it remains to be seen whether the recovery in property prices will be sustained. For the time being, then, I am sticking with what I have in Bricklane, though I am not planning to top up my investment with them currently.

More generally, my experiences with Bricklane have been good. The sign-up process was fast and simple, and my £125 referral bonus (see below) was credited to my account instantly, completely offsetting (with a bit to spare) the initial 2% charge.

I also like the fact that any investment with Bricklane is automatically diversified across a range of properties, thus reducing volatility and risk. By contrast, with many P2P loan and property crowdfunding platforms, you invest in one loan or property at a time.

It’s also reassuring that you can ask to withdraw your money at any time – this can be an issue with property crowdfunding platforms in particular. As mentioned earlier, this does depend on someone else being willing to buy your shares, but Bricklane say that to date there hasn’t been a problem for anyone wanting to sell. As I said above, I had no issues when I wanted to release £1,000 from my own investment with them.

It is important to note that this is an investment rather than a savings account, and it does not therefore enjoy the same level of protection as bank and building society savings, which are covered (up to £85,000) by the Financial Services Compensation Scheme (FSCS).

Clearly, no-one should put all their spare cash into Bricklane (or any other investment platform). Nonetheless, in my view it is worth considering as part of a diversified portfolio. Not only are the rates of return (other than the last few months) higher than those offered by most banks and building societies, they are less affected than shares by ups and downs in the stock market. Property investments aren’t a way of hedging your equity-based investments directly, but they do help spread the risk.

In addition, the tax treatment of REITs make them a highly tax-efficient investment, especially if you can invest in the form of a SIPP or an ISA.

Welcome Offer

As an existing Bricklane investor, I can offer a special cashback deal for anyone signing up and investing on the platform via my link. If you click through this special invitation link, sign up and invest a minimum of £5,000, you will receive £125 in cashback (and I will get £100). With a £5,000 investment this bonus will cover your initial 2% charge and still leave you £25 in profit 🙂

If you invest more, you will get even more cashback, as follows:

Over £10,000 – £250

Over £20,000 – £500

Over £50,000 – £800

Over £100,000 – £1,500

Not only that, once you are an investor with Bricklane, even if you only start with £100, you will be able to offer the same cashback bonus to your friends and relatives and earn commission yourself as well. There is no limit to the number of people you can introduce through this scheme.

Obviously, this is a generous promotional offer by Bricklane and I assume it won’t be available forever. If you want to take advantage, therefore, don’t wait too long. I will remove this information if/when I hear the offer is no longer valid.

If you have any comments or questions about this Bricklane review, as always, please do leave them below.

Disclosure: this post includes affiliate links. If you click through and make an investment at the website in question, I may receive a commission for introducing you. This has no effect on the terms or benefits you will receive. Please note also that I am not a professional financial adviser. You should do your own ‘due diligence’ before making any investment, and seek professional advice from a qualified financial adviser if in any doubt how best to proceed.

Note: This is a fully revised and updated version of my original Bricklane review from October 2018

UPDATE 15 March 2020: Having said that my earnings from my Bricklane ISA over the last 6-8 months were disappointing, since the start of February they have shot up by over 100% (see below).

This doesn’t exactly cancel out the recent falls in my equity-based investments due to the coronavirus, but it does demonstrate the value of having a well-diversified portfolio. And I am obviously feeling more positive about Bricklane as an investment platform now 🙂

One other thing to note is that until the end of April 2020 Bricklane are waiving all investment fees for both new and existing investors. Visit the Bricklane website for more information.