My Investments Update – January 2023

Happy New Year! Here is my latest monthly update about my investments. You can read my December 2022 Investments Update here if you like

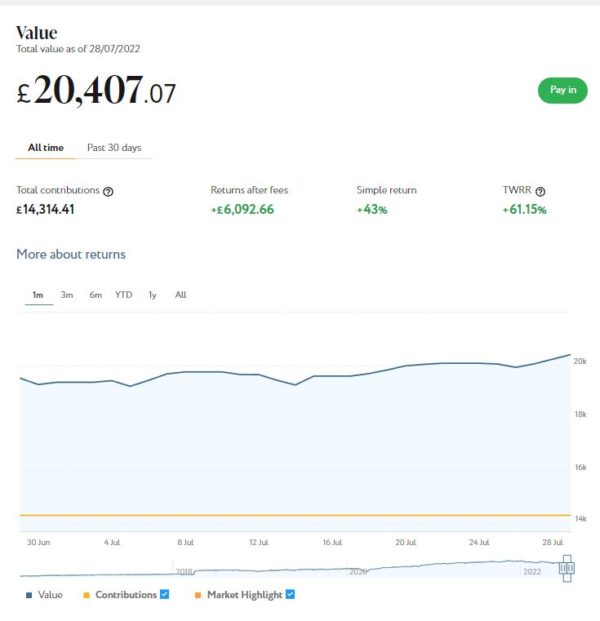

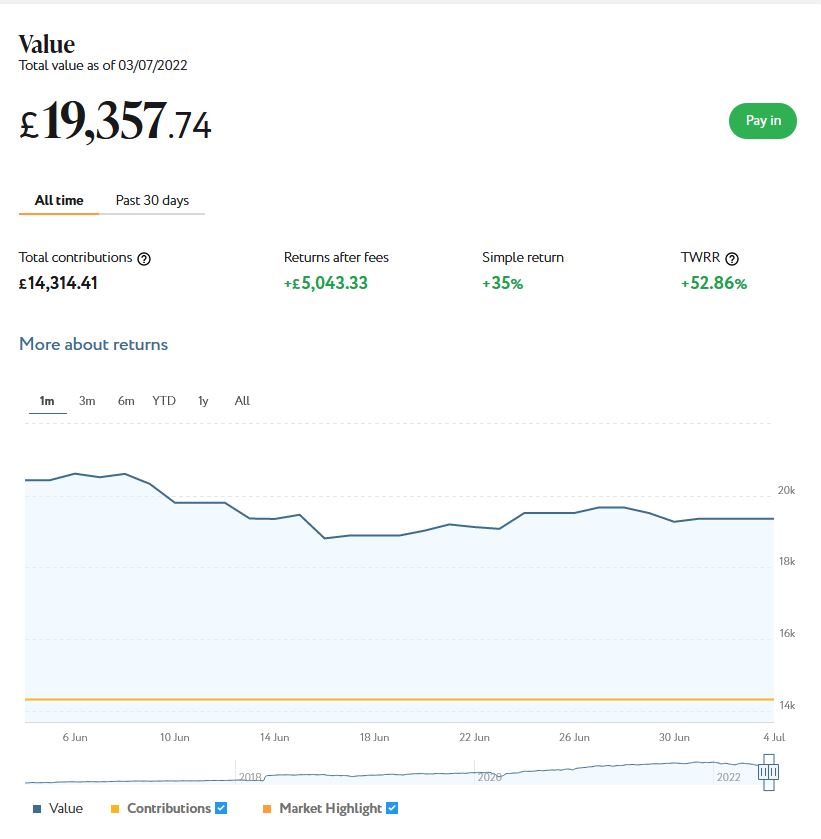

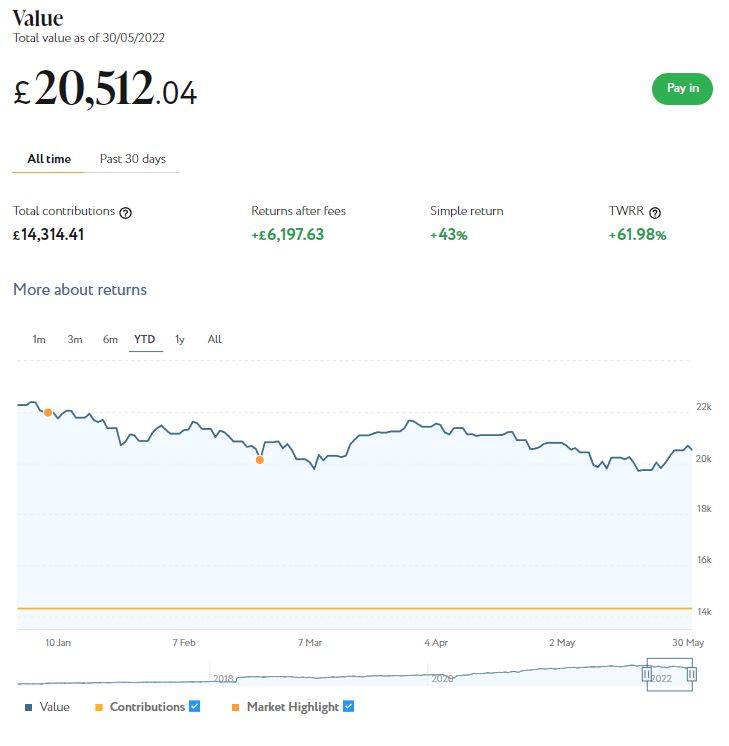

I’ll begin as usual with my Nutmeg Stocks and Shares ISA. This is the largest investment I hold other than my Bestinvest SIPP (personal pension), from which I recently started withdrawing again.

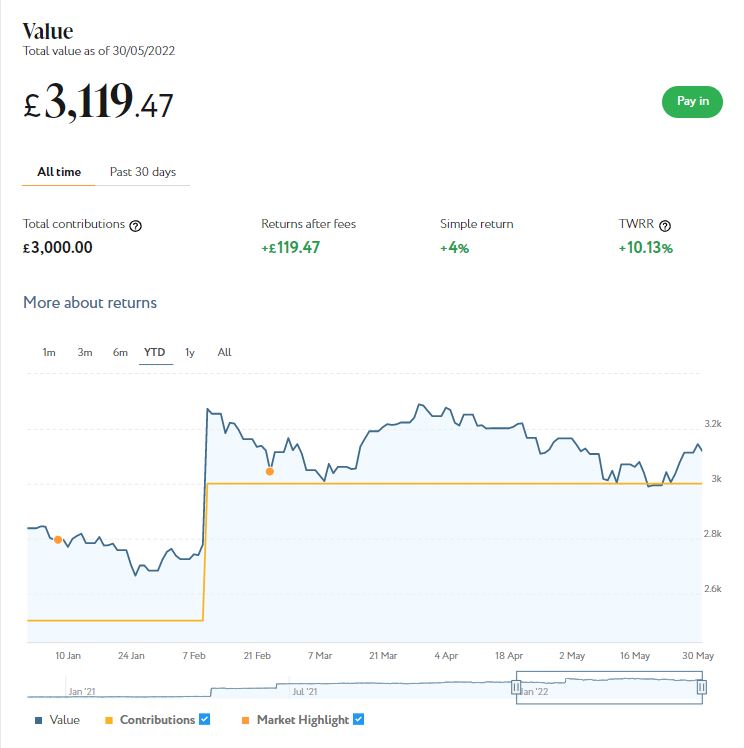

As the screenshot below of performance over the last year shows, my main Nutmeg portfolio is currently valued at £19,898. Last month it stood at £20,391 so that is a fall of £493.

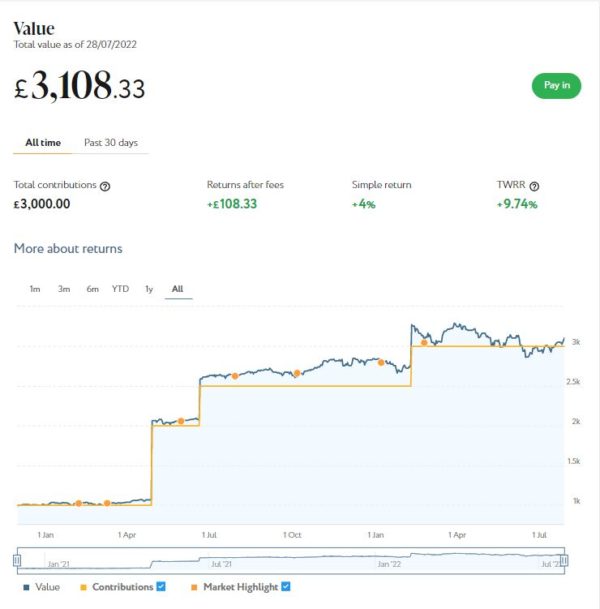

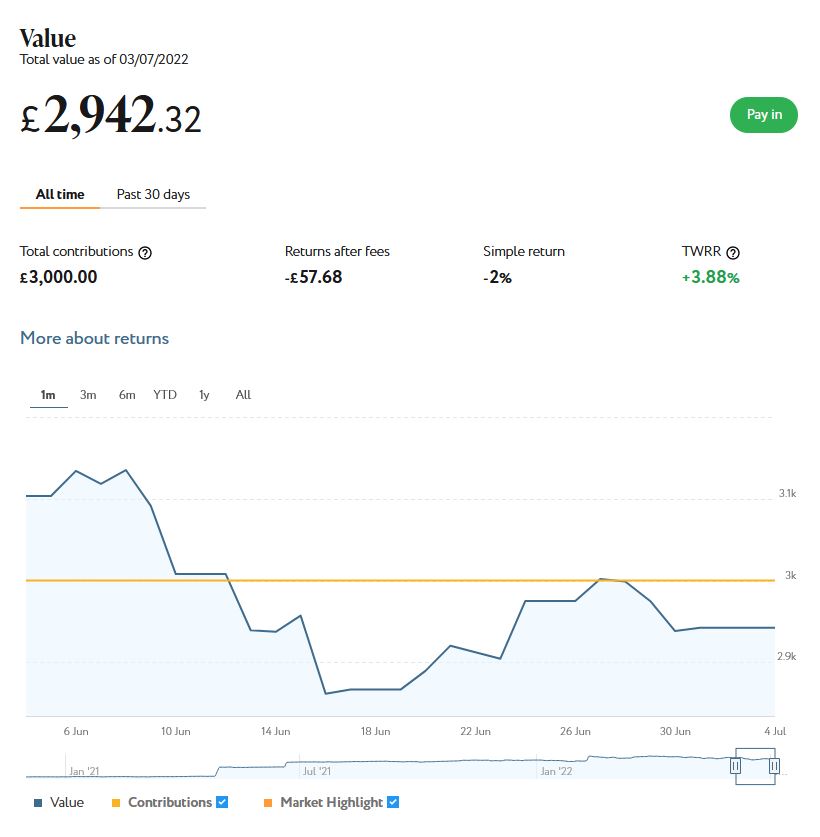

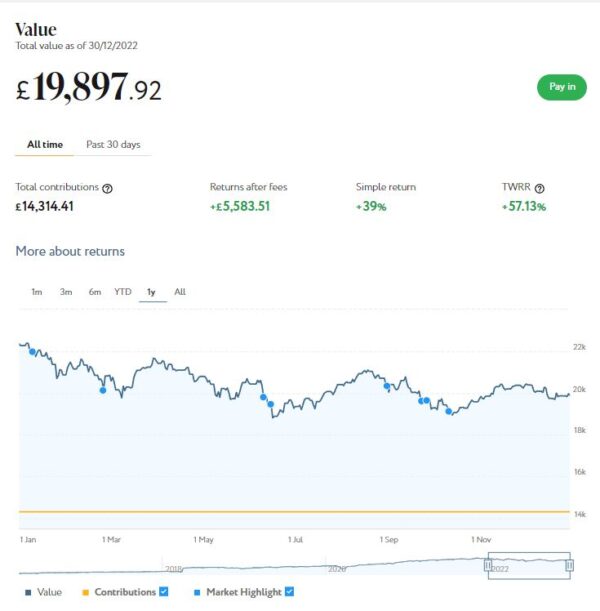

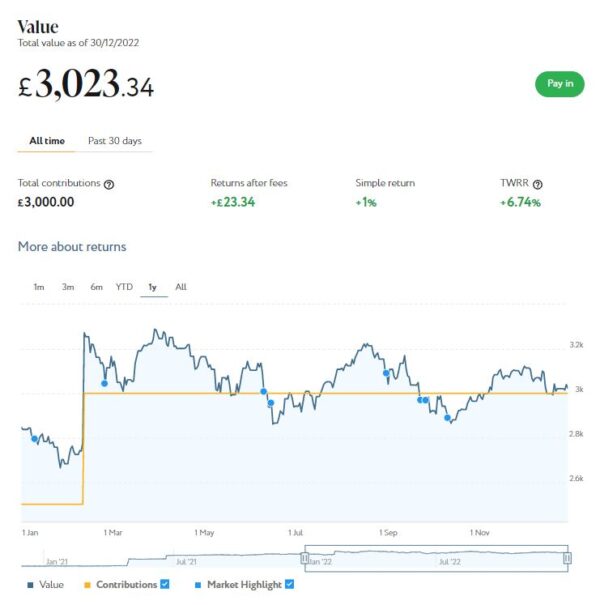

Apart from my main portfolio, I also have a second, smaller pot using Nutmeg’s Smart Alpha option. This is now worth £3,023 compared with £3,114 a month ago, a decrease of £91.

Here is a screen capture showing performance over the last year. As you can see from the ochre line, I topped up this account in February 2022.

That is a net month-on-month decrease of £584. That is obviously disappointing, but needs to be set against an increase of £785 the month before.

As the charts above clearly illustrate, 2022 was a volatile year for stock market investments generally. The outlook is still uncertain, but according to this article in the Financial Times the majority view is that stock markets overall will remain flat or see a very modest recovery in 2023. But obviously a lot depends on world events. If the war in Ukraine ends and/or China makes a reasonably smooth recovery from the pandemic, things could improve faster. Probably the best strategy, as this article from Forbes puts it, is to hope for the best but be prepared for the worst!

Overall, my Nutmeg investments are down £2,191 or about 8.7% since the start of 2022. To put this in context, though, in 2021 they rose in value by £3,552. And I am still more than £5,600 ahead since I started investing with Nutmeg in 2016. For my main portfolio that represents a return on capital of 39.01% or 57.13% time-weighted. My Smart Alpha portfolio hasn’t been going as long, but it is at least showing a small profit on the total I have put into it 🙂

Of course, the main lesson from all this is that investing is (or should be) a long-term endeavour. Over a period of years stock market investments such as those used by Nutmeg typically produce better returns than cash accounts, often by substantial margins. But there are never any guarantees, and in in the short to medium term at least, losses are always possible.

You can read my full Nutmeg review here (including a special offer at the end for PAS readers). If you are looking for a home for your annual ISA allowance, based on my overall experience over the last six years, they are certainly worth considering.

Moving on, my Assetz Exchange investments continue to generate good returns. Regular readers will know that this is a P2P property investment platform focusing on lower-risk properties (e.g. sheltered housing). I put an initial £100 into this in mid-February 2021 and another £400 in April. In June 2021 I added another £500, bringing my total investment up to £1,000.

Since I opened my account, my AE portfolio has generated a very respectable £91.61 in revenue from rental income. Capital growth has stalled, though, in line with what is happening in housing markets more generally. While some of ‘my’ properties are still showing gains, others are showing losses on capital. Overall my portfolio is currently showing a small net decrease in value of £7.88.

The latter is obviously a little disappointing, although of course capital values are largely academic unless and until you want to sell. The rental income is still coming in steadily without any issues or dramas. As I’ve said before, £91.61 is a decent rate of return on my £1,000 and does illustrate the value of P2P property investments for diversifying your portfolio when equity markets are volatile. And it doesn’t hurt that with Assetz Exchange most projects are socially beneficial as well.

- To control risk with all my property crowdfunding investments nowadays, I invest relatively modest amounts in individual projects. This is a particular attraction of AE as far as i am concerned. You can actually invest from as little as 80p per property if you really want to proceed cautiously.

My investment on Assetz Exchange is in the form of an IFISA so there won’t be any tax to pay on profits, dividends or capital gains. I’ve been impressed by my experiences with Assetz Exchange and the returns generated so far, and intend to continue investing with them. You can read my full review of Assetz Exchange here. You can also sign up for an account on Assetz Exchange directly via this link [affiliate].

Another property platform I have investments with is Kuflink. They continue to do well, with new projects launching almost every day. I currently have around £2,400 invested with them in 18 different projects (I withdrew £200 in December to help pay for Christmas). To date I have never lost any money with Kuflink, though some loan terms have been extended once or twice. On the plus side, when this happens additional interest is paid for the period in question.

My loans with Kuflink pay annual interest rates of 6 to 7.5 percent. These days I invest no more than £200 per loan (and often less). That is not because of any issues with Kuflink but more to do with losses of larger amounts on other P2P property platforms in the past. My days of putting four-figure sums into any single property investment are behind me now!

- Nowadays I mainly opt to reinvest the monthly repayments I receive from Kuflink, which has the effect of boosting the percentage rate of return on the projects in question

Obviously a possible drawback with Kuflink and similar platforms is that your money is tied up in bricks and mortar, so not as easily accessible as cash savings or even (to some extent) shares. They do, however, have a secondary market on which you can offer any loan part for sale (as long as the loan in question is performing and not in arrears). Clearly that does depend on someone else wanting to buy it, but my experience has been that any loan parts offered are typically snapped up very quickly. So if an urgent need arises, withdrawing your money (or part of it) is unlikely to be an issue.

You can read my full Kuflink review here. They offer a variety of investment options, including a tax-free IFISA paying up to 7% interest per year with built-in automatic diversification. Alternatively you can now build your own IFISA, with most loans on the platform (including the one shown above) being IFISA-eligible.

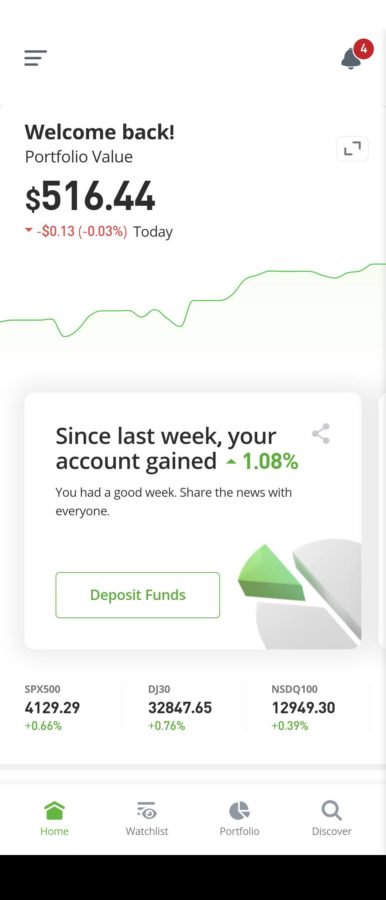

Last year I set up an account with investment and trading platform eToro, using their popular ‘copy trader’ facility. I chose to invest $500 (then about £412) copying an experienced eToro trader called Aukie2008 (real name Mike Moest). My investment has been up and down in the last few months, but it is currently $33 (about £27) in profit. In these turbulent times I am quite happy with that.

In any event, I’m looking on this as a long-term investment so won’t be judging it yet. I am also considering a further investment with eToro, probably in one of their themed portfolios. You can read my full review of eToro here. You may also like to check out my recent more in-depth look at eToro copy trading.

- You might also like to know that eToro recently introduced the eToro Money app. This allows you to deposit money to your eToro account without paying any currency conversion fees, saving you up to £5 for every £1,000 you deposit. You can also use the app to withdraw funds from your eToro account instantly to your bank account. I tried this myself recently and was impressed with how quickly and seamlessly it worked. You can read my more in-depth article about eToro Money here.

I had two more articles published in December on the always-excellent Mouthy Money website. One addressed the question of whether you can Save Money by Cancelling Your TV Licence. I looked at what this entails and what TV you are still permitted to watch without a licence. I also set out some ways you may be able to save money on your TV licence if cancelling altogether is a bridge too far for you.

My other piece was Why We All Need to Be a Bit More Branson! The title is obviously tongue-in-cheek. But the article sets out my strongly held view that – in these challenging times especially – we can all benefit from being a bit more entrepreneurial. I really enjoyed writing this one, I must admit!

Last month I updated my post about the Warm Home Discount, which this year is being increased from £140 to £150. The eligibility rules are changing somewhat, and I shall probably be one of the people who misses out, which is clearly disappointing. But on the plus side, most people won’t now have to apply for this benefit – if you are eligible, the grant should be applied automatically to your bill by your energy company.

- The government’s Help for Households website has a helpful summary of all the financial assistance currently available and is regularly updated.

My other posts from December included What Are The Best Video Calling Tools for Older People? and an expert guest post on the subject Why a Passion Investment Could be the Way Forward in Times of Economic Uncertainty. I found the latter quite an eye-opener, as it includes important info about Capital Gains Tax (CGT) I wasn’t previously aware of. The article also sets out some reasons to consider ‘passion investments’ such as fine wines or vintage cars, due to the tax advantages they can confer.

Finally, I published My Top 20 Posts of 2022, which I hope you will check out as well!

That’s all for today. I hope you and your family are coping in these undoubtedly challenging times, and wish you a happy, healthy and prosperous 2023.

As always, if you have any comments or queries, feel free to leave them below. I am always delighted to hear from PAS readers

Disclaimer: I am not a qualified financial adviser and nothing in this blog post should be construed as personal financial advice. Everyone should do their own ‘due diligence’ before investing and seek professional advice if in any doubt how best to proceed. All investing carries a risk of loss.

Note also that posts may include affiliate links. If you click through and perform a qualifying transaction, I may receive a commission for introducing you. This will not affect the product or service you receive or the terms you are offered, but it does help support me in publishing PAS and paying my bills. Thank you!