Assetz Exchange: My Review of This P2P Property Investment Platform

Today I’m looking at P2P property investment platform Assetz Exchange (launched in January 2019)..

As I have noted before on Pounds and Sense, I am something of an enthusiast for property investment (and specifically property crowdfunding). Among other things, I like the fact that you can make money from both rental income and capital growth. And investing in property can be a good way of spreading the risk when you have equity-based investments.

Of course, investing in property directly is costly and carries all the risk inherent in putting all your eggs in one basket. A major attraction of P2P property crowdfunding investment is that you can get started with much less money and build a diversified portfolio to help mitigate the risks.

In addition, if you invest this way you don’t have to deal with the day-to-day hassles of being a landlord, from finding tenants to repairing broken boilers. This is taken care of by the platform itself and/or their management company. You just have to sit back and – all being well – wait for the rental income and (hopefully) capital gains to materialize.

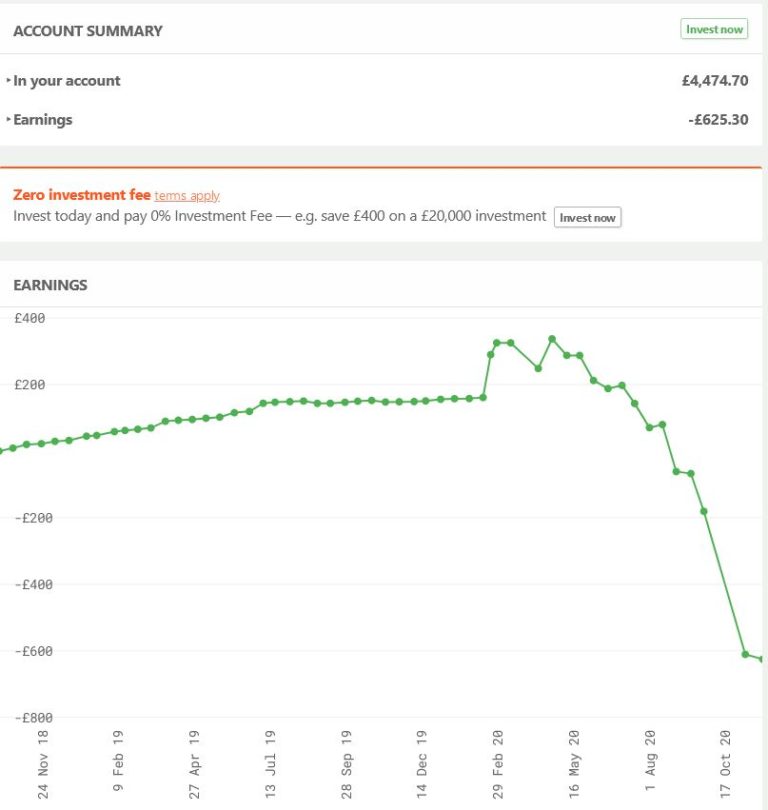

That said, there have been a few reversals in the P2P property sector over the last few months (see this recent post, for example). So I am now more concerned than ever to ensure that any investments I make in this category control risk as effectively as possible.

What Is Assetz Exchange?

As mentioned above, Assetz Exchange is a licensed P2P property investment platform. It is owned by well-known P2P lending platform Assetz Capital, but run quite separately from them. If you already have an account with Assetz Capital, you will have to register separately with Assetz Exchange.

Assetz Exchange aims to offer net yields to investors of between 5.2 and 7.2% per year. These are generally paid by institutional tenants through multi-year leases. All properties are unleveraged, providing additional security (and stability) for investors.

Assetz Exchange has some similarities with Property Partner, but they differ in some important ways. For one thing, many of the properties are rented out to charities (e.g. NACRO) or housing associations. These organizations generally sign longer contracts than private individuals. They don’t have voids (periods when the property is untenanted and producing no income). Neither are there any maintenance costs, as the organizations take responsibility for this themselves. And finally, these organizations are directly funded by the government, giving them a secure income stream.

Another area of specialism is show homes. Working with a national housebuilder, Avant Homes, Assetz Exchange purchases fully furnished show homes from multiple sites around the country. These are then leased back to the developer for fixed periods of up to five years to be used to help sell other plots. This eliminates potential void periods and avoids any maintenance costs. At the end of the leases, investors will be able to vote on whether to lease the houses to tenants or sell them to home-buyers on the open market.

Assetz Exchange also offers investors the chance to get involved with a new generation of modular eco-homes. This is already a popular approach to house-building in Europe and the United States. Assetz Exchange fund the acquisition and conversion of land into serviced plots, allowing buyers to then order a house to be built on that plot to their own specification. These modular-built eco-homes are sustainable and low energy. They are also typically quick to complete and have a lower impact on the environment.

Assetz Exchange do also buy and let some standard properties as well, offering investors the chance to further diversify their portfolios.

Signing Up

Before you can invest through Assetz Exchange, you will of course have to sign up on the platform. This is pretty straightforward. You just visit the Assetz Exchange website, read the information there, and click on Register in the top-right-hand corner.

You will then be required to enter your contact details and confirm which of four categories of investor you fall into. The options are as follows:

High Net Worth Investor – This includes individuals who have an annual income of £100,000 or more or net assets of £250,000 or more.

Self-certified Sophisticated Investor – This includes individuals who have made more than one peer-to-peer investment in the last two years or who meet certain other criteria relating to investment experience. This is the category I selected myself.

Investment Professional – Including corporate investors and SIPP or SSAS professional service providers.

Everyday Investor – This category is for investors who don’t fit into any of the categories above. They can still invest via Assetz Exchange but must pledge not to invest more than 10 per cent of their portfolio in P2P loans.

You will also be required to answer some multiple-choice questions to confirm that you understand the nature of investments that can be made on the platform. I found some of these questions quite challenging, and was pleased to get them all right first time. I would therefore recommend reading the information on the Assetz Exchange website (including the Help pages) carefully before proceeding to register. If you do make any mistakes, however, feedback is provided, and you can take the test again until you achieve a 100% correct score.

Once you have done all this, you will be able to fund your account. This must be done by bank transfer, as Assetz Exchange do not allow debit card payments. You will then be able to browse the range of currently available property investments:

Investing

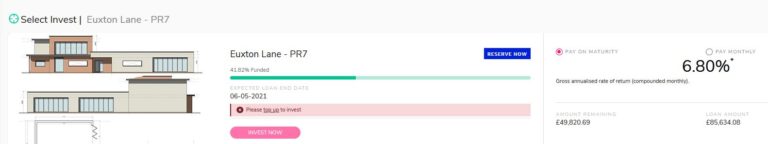

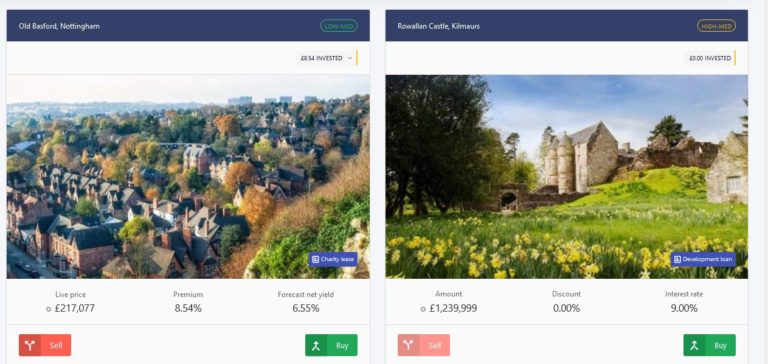

Once you are registered on the platform and signed in, click on Exchange in the menu at the top of the screen and all current projects will be displayed. Here are a couple that are showing at the time of writing…

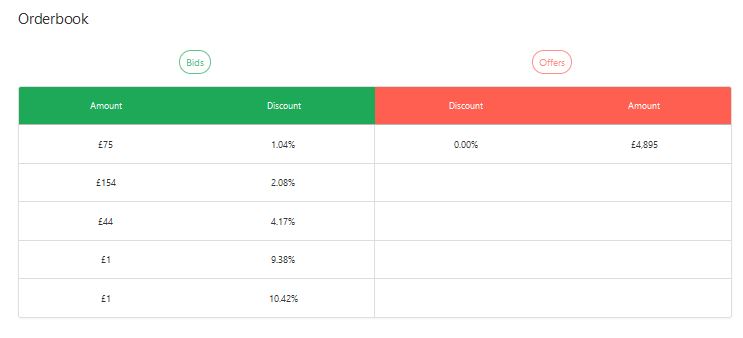

Clicking on any of these will open a page devoted to the investment concerned. Here you can read all about it, view reports and site plans, and so on. One very important area is the Order Book (see example below).

All buying and selling on the platform is conducted via an exchange (otherwise known as the Order Book) which works similarly to the secondary market on Property Partner.

So if you want to buy shares in a particular project, you can do so by accepting the best price currently available on the exchange. In the example above, there are £4,895 of shares available at zero discount (i.e. the original offer price).

If you want to get your shares at a lower price than this, you can make a bid. In the example, an investor has put in a bid for £75 at a 1.04% discount and another investor (or maybe the same one) has put in a bid for £154 at a 2.08% discount.

Conversely, if you wish to sell some or all of your shares at any time, you can accept the best bid (or bids) on the Order Book currently, or place an offer and wait to see if this is matched.

It does take a little bit of getting your head around at first, but it’s actually a simple and straightforward process. One thing to note is that if there is nothing showing on the right-hand-side of the Order Book (under Offers) you won’t be able to buy shares in that project there and then – though you can of course place a bid if you wish and see if a seller wants to match it.

In any event, if you want to buy, just click on the green Buy button (either on the Exchange page or the details page) and complete the short online form. You will need to indicate how much you want to invest, whether this should be from your General or IFISA account (see below), and whether the amount should include the FCC or not (see What Are The Charges? below).

You will also need to indicate whether you want to buy at the current best price (selected by default) or you want to try for a better price (in which case your bid will be added to the left-hand column in the Order Book).

The IFISA Option

As mentioned above, if you wish you can invest with Assetz Exchange via an IFISA (Innovative Finance ISA). As discussed in this recent post, this type of ISA for P2P investing gives you the same tax advantages as a cash or stocks and shares ISA. You don’t have to pay any tax on the money you make, whether this takes the form of dividends, income or capital gains.

Everyone has a generous annual ISA allowance of £20,000 in the current 2020/21 tax year (and next year as well). This can be divided any way you like among the three types of ISA. So if you open an Assetz Exchange IFISA, you can still have cash and stocks and shares ISAs with other providers as well, so long as you don’t invest more than £20,000 in total. You can also only invest money in one of each type of ISA in any one financial year.

Choosing the IFISA option on Assetz Exchange is very easy. You can do it when first registering on the site or later. The only extra thing you have to do is enter your National Insurance number.

If you have maxed out your ISA allowance – or have already invested in another IFISA in the current tax year – you can still invest via your default ‘Regular’ account. You can invest any amount this way, but of course any profits you make will potentially be taxable.

What Are The Fees?

Assetz Exchange do not charge any monthly fees to investors (this is in contrast to Property Partner, who made the unpopular decision to impose an Assets Under Management charge and monthly fee, greatly impacting small investors on the platform especially). The company does have to make money somehow, of course, and they do this from three sources:

Arrangement fee

When a property is first purchased, Assetz Exchange charge an arrangement fee which is included in the Fixed Costs & Contingency (FCC). When parts of the property are sold on the Exchange, this fee is added to the purchase price of the buyer (see above) and so is recovered by the seller. The size of this fee is included in the loan conditions.

Monitoring fee

Assetz Exchange charge a percentage of the gross rent received for the property. The percentage is stated in the loan conditions of the property.

Property disposal fee

A fee of 2% of the gross sales proceeds is charged if investors vote to sell and the property is physically sold.

What Are The Safeguards?

Like most other property crowdfunding platforms, all investments in any project on Assetz Exchange are held in a Special Purpose Vehicle (SPV) for the project concerned. This gives investors in the project some protection if the main company were to go into administration.

A contingency balance is held within each SPV which acts in a similar manner to a provision fund, covering unexpected short-term cash-flow disruptions. It is topped up from receipts and no distributions are made to investors if it falls below a certain level.

SPVs also benefit from indemnity insurance which covers non-payments from tenants. This in theory also covers disruption to cash-flow, but it does not cover voids (periods where the property does not have a paying tenant). For reasons mentioned above, voids should not be an issue with most of the properties listed on the platform.

In common with most other P2P investment platforms, Assetz Exchange does not fall within the remit of the Financial Services Compensation Scheme (FSCS), which covers customers with UK financial services firms up to £85,000 if the institution in question were to go bust.

Pros and Cons

Here is my list of pros and cons for Assetz Exchange.

Pros

1. Fast, easy sign-up.

2. Well-designed, intuitive website.

3. Low minimum investment (as little as 80p per project!) – this makes building a diversified portfolio straightforward.

4. Assetz Exchange take care of all the work involved in buying and managing properties. You just choose which ones to invest in.

5. Option to access money any time by selling on the secondary market (though this does depend on another investor being willing to buy your shares at a price you find acceptable).

6. Relatively low-risk investment options (though of course there are no guarantees)

7. Customer support (in my experience anyway) is fast, friendly and helpful.

8. Charges are reasonable. There is no charge for selling investments.

9. Potential to make money through both capital appreciation and rental income.

10. Rental income is paid into your account every month. You can either withdraw or reinvest it.

11. No monthly fees and only transaction-based charges to pay.

12. Opportunity to invest in socially beneficial developments such as sheltered housing

13. Tax-free IFISA option to which any investment on the platform can be added

14. Investors can vote for their favoured exit option (e.g. selling up) when the time comes

Cons

1. Can’t invest using a debit card

2. No auto-invest option currently available

3. Not as many opportunities as some P2P platforms (although the number is increasing steadily)

Closing Thoughts

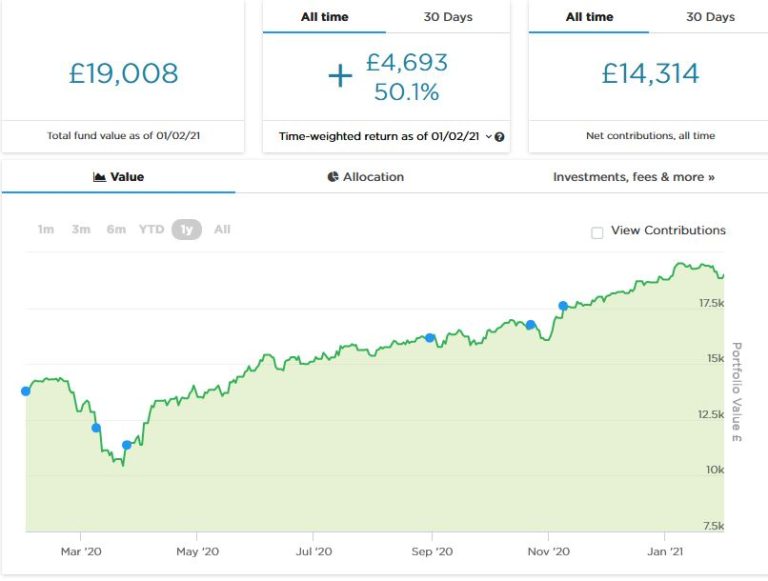

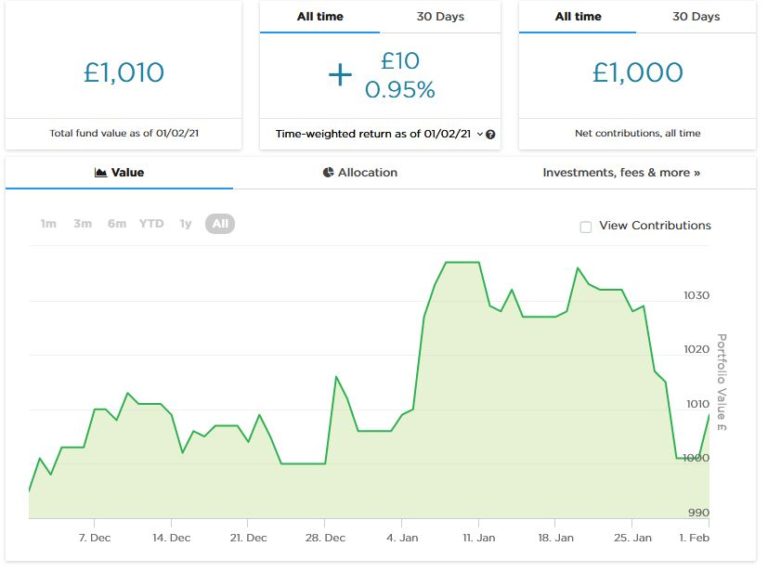

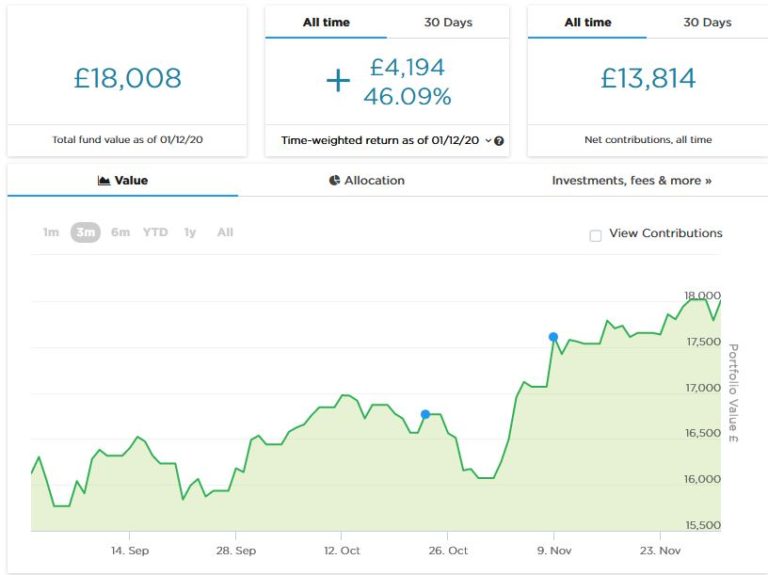

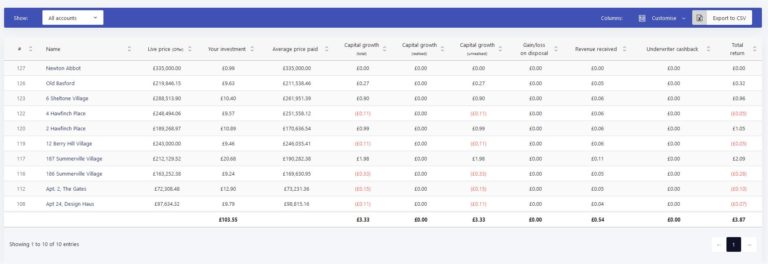

I was impressed enough with Assetz Exchange to invest a small amount (£100) of my own money initially and will report back on PAS about how my portfolio fares. Here is how it’s looking at the time of writing, roughly a month after I opened my account. As you can see, my initial investment has grown by £3.87 from a combination of income received and capital growth. For a month that’s not bad at all – if it carries on growing at that rate I’ll be delighted! – but of course it is much too soon to draw any firm conclusions from this.

I particularly like the fact that with the low minimum investment on Assetz Exchange, even if you’re starting very cautiously (as I am) it’s easy to build a diversified portfolio. I like the relative simplicity of investing on the website and the fact that you can exit an investment any time via the exchange (though that does depend on willing buyers being available at a price that is acceptable to you). It is also good that there are no charges associated with selling on the exchange.

- You can, of course, withdraw uninvested funds from your Assetz Exchange account at any time.

Obviously there are risks in any form of investing and it is important to do your own ‘due diligence’ before proceeding. You should also bear in mind that this type of investment is not covered by the Financial Services Compensation Scheme, which covers savers with UK banks and other financial institutions up to £85,000. On the other hand, the potential returns are significantly better than the fractions of a percent typically on offer from savings institutions right now, while the risks appear to be at the lower end of the spectrum, with many of the properties on long-term leases with corporate/institutional tenants.

To be very clear, nobody should put all their spare cash into Assetz Exchange (or any other investment platform for that matter) but in my opinion there is definitely a case for including AE within a diversified portfolio.

As mentioned above, I shall be reporting back on how my Assetz Exchange investments perform on PAS in future. In the mean time, if you have any comments or questions about this post, or Assetz Exchange more generally, please do leave them below as usual.

Disclaimer: I am not a registered financial adviser and nothing in this post should be construed as personal financial advice. You should always perform your own ‘due diligence’ before making any investment and speak to a qualified professional adviser if in any doubt how best to proceed. All investments carry a risk of loss.

Please note also that this review uses my affiliate links. If you click through and make an investment or perform some other qualifying transaction, I may receive a commission for introducing you. This will not affect any charges you pay or the product/service you receive.