Is It Worth Getting Batteries for Your Solar Panels?

A couple of weeks ago I got home from a short break to find a letter and glossy leaflet on my doormat extolling the benefits of batteries for solar panel owners.

The letter said the company had purchased a list of names of local solar panel owners including my details. That put my back up a bit, as I’m not keen on having my personal information bought and sold. But I guess it’s publicly available info, so there isn’t really anything I can do about it.

Anyway, while I didn’t reply to the sales letter, it did inspire me to do a bit of research into solar energy storage batteries and whether they are worthwhile. That turns out to be quite a difficult question to answer. It doesn’t help that much of the information online comes from solar battery suppliers and installers, who are not exactly unbiased.

So here are my thoughts, based on what I have been able to find out in conjunction with my own experiences as a solar panel owner.

The Idea

The idea behind solar batteries is simple and appealing.

Solar (photovoltaic) panels generate most power when the sun shines, but this is probably not when you need it the most. If they are generating electricity in the day when you are out at work, some of that power is likely to be going to waste. (Yes, you might be able to sell some back to the grid, but most home-owners are paid a – low – ‘deemed’ tariff for this based on the total amount of power their panels generate. It makes no difference to this how much of the electricity generated you use yourself.)

If you have batteries, though, these can be charged by your panels when they are making more electricity than you need, and then used to provide power at other times (e.g. in the evening) when you need it. This should reduce the amount of electricity you have to buy, thus cutting your bills. It may also give you a backup in the event of power cuts (although don’t bank on this – see below).

The Reality

That all sounds great in theory, but the reality is a lot more complicated.

First of all, solar storage batteries are still new and, to a degree, untested technology. They are also expensive. To have batteries supplied and fitted to an existing solar panel installation is likely to cost anywhere from £5,000 to £10,000.

Solar batteries also have limited lifespans. Because the technology is so new, nobody is really sure how long they will last, but I have seen figures of 5 to 15 years quoted. That means you are likely to need to replace your batteries at least once during the 20- to 25-year working life of your solar panels.

It’s also worth bearing in mind that all batteries become less efficient over time, reducing the amount of electricity they are able to store.

My Calculation

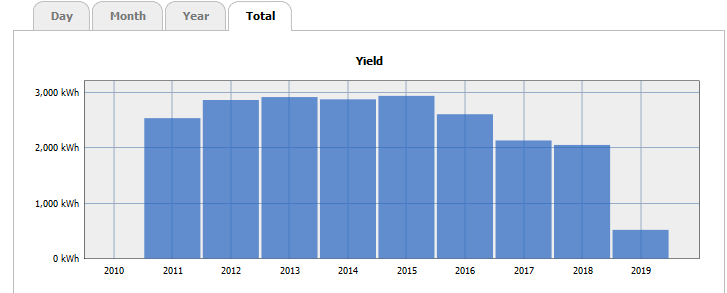

I thought I would look at my own solar panels as an example, to see if the sums added up. First of all, here is a chart showing the total amount of electricity generated by my panels since they were installed in 2011.

As you can see, the maximum my panels have generated is just under 3,000 kWh in 2015 (after that the output declined somewhat, for reasons discussed in this blog post). For the sake of my calculation, though, let’s use a figure of 3,000 kWh for the amount of power my panels generate annually.

Now, to work out how much power could be saved by installing batteries, we need to know what proportion of power generated is surplus to my requirements and currently ‘wasted’. Because I work from home and am here in the day most days, I can’t believe this is any more than 30 percent. In reality it is probably less, but I’ll use 30% for my calculation.

Let’s now assume that batteries would allow me to save the whole of that 30% (in reality that’s highly unlikely for reasons I’ll discuss shortly). That means I would be saving 3,000 kWh x 30% = 900 kWh. The electricity companies in my area currently charge in the region of 20p per kWh (including VAT), so the saving on my bill would theoretically be worth 900 x 20p = £180 a year. Assuming the cost of buying solar batteries and having them installed was an optimistic £5,000, that means it would take 5000/180 = 28 years for the cost to be recouped – well above the expected lifespan of the battery (or the panels, for that matter).

Even if I was out a lot in the day, to the point where I could save 60% of the power generated by my panels if I had batteries, the breakeven period would be 14 years. And remember, this is also assuming the highest possible output from my panels every year and 100% battery efficiency, neither of which will be the case in reality.

Complications

There is one thing you may have noticed that I didn’t account for in my calculation, and that is the fact that electricity prices go up every year. That will, of course, have the effect of increasing the potential savings from batteries and reducing the time it takes to break even. If electricity prices go up dramatically, that will certainly make solar storage batteries more attractive.

On the other hand, there are some negative factors to take into account as well. Here are just some of them.

1. Batteries are not 100% efficient. Some energy is lost charging the battery and then releasing energy from it. The technical term for this is round trip efficiency. Typically this figure is around 80%, meaning that for every 5 kWh going in to your battery, you will only get 4 kWh of useful electricity out.

2. You can only charge a battery to its maximum (100%). If on a sunny day the batteries become fully charged, any surplus energy generated after that will simply go back to the grid.

3. If you discharge a battery fully this can significantly reduce its life expectancy. Technically this is known as Depth of Discharge, or DoD for short. Most manufacturers specify a maximum DoD for optimal performance. For example, if a 10 kWh battery has a (typical) DoD of 90 percent, you shouldn’t use more than 9 kWh of the battery before recharging it. In practice, an electronic charge controller prevents over-discharging (and over-charging) from happening. The effect of this is, of course, to reduce the amount of useful energy a battery can store.

4. Batteries become less efficient over time. This varies according to the type and make of battery, but typically over 10 years efficiency will reduce by 30%. Again, this reduces the amount of electricity batteries can store and the potential savings to be made. If you are unlucky and your battery fails completely just as the warranty expires, you could be looking at a large overall loss.

5. If you use batteries to store power, this may involve sacrificing the payments you would otherwise receive for exporting power back to the grid. This may not matter if you are getting a ‘deemed’ payment based on electricity generated (as is the case for many owners currently). But with the new generation of smart meters which can measure how much electricity you are actually returning to the grid, you will certainly end up making less money this way if you divert excess electricity to batteries instead.

6. As well as the cost of buying and installing solar batteries, there is also VAT to take into account. At the time of writing this is 5%, but it is going up to 20% in October 2019. This would add £1,000 to the price of a £5,000 battery installation.

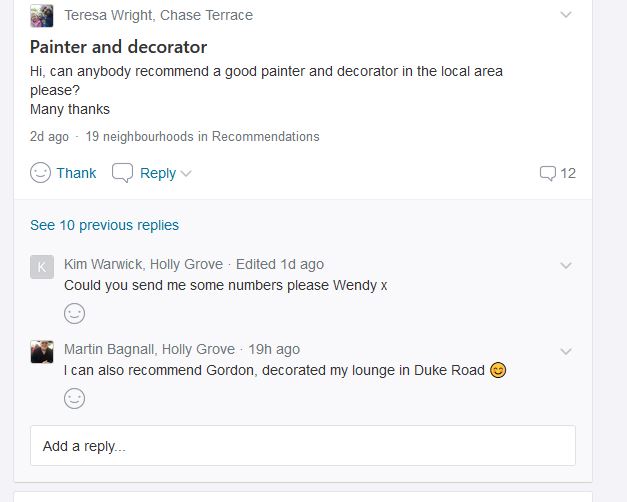

7. Finally, although solar batteries may give you a backup power source in the event of power cuts, it appears this cannot be relied on. A survey of solar battery owners by The Consumer Association found that several people reported that in the event of a power cut, their batteries stopped working as well. That is despite promises made by sales people that this wouldn’t be the case.

My Conclusions

As I said earlier, this is a complicated field and I make no claim to any special expertise on it. However, based on my own data and research, here are the conclusions I have reached.

1. If you and/or other family members are typically at home in the day, it is doubtful whether you will save enough money by installing batteries to cover the cost, let alone make any profit. The same may apply if you use electricity in the day for other purposes when nobody is there in person, e.g. washing laundry, heating water, running a dishwasher, etc.

2. If nobody is in your home for most of the day and you aren’t using any significant amount of electricity during daylight hours then the savings from batteries may be more worthwhile. But bear in mind that you are still likely to be around (and using electricity) at weekends, early mornings, evenings, holidays, sick days, and so on. And some household appliances such as fridges and freezers go on using electricity all of the time.

3. If the price of energy rises sharply, solar batteries may become a more attractive proposition. However, they are expensive to buy and install, and have various limitations (discussed above) which may reduce the benefit you get from them. They will probably also have a shorter lifespan than your panels, meaning they will need replacing at least once over the lifetime of your panels. And they will in any event decline in efficiency over time.

4. Likewise, if battery prices fall – and the technology improves – that will increase the attractiveness of solar batteries in future. But of course, if you are considering whether to get batteries now, you can only base your decision on what is currently available.

5. If you are buying a new home and/or new solar panels, buying batteries at the same time is likely to be more cost-efficient (and involve less hassle) than retro-fitting them. In this article I am mainly addressing existing solar panel owners.

6. I am also looking at this primarily from a financial standpoint. There is a case to be made for installing batteries to help contribute to the fight against global warming and climate change, although there are obviously also environmental costs involved in battery manufacture. In any event, it is for each individual to decide how important this is to them and whether the environmental benefits of having batteries with their solar panels really do stack up.

7. Some companies are currently making a big push to promote solar batteries, and it does appear to me that some of the claims made on their behalf are exaggerated to say the least. If you are thinking of getting solar batteries, be sure to do your own ‘due diligence’ and don’t believe everything you read on company websites or are told by pushy salespeople. In particular, be very sceptical about pie-in-the-sky estimates over how much money batteries may be able to save you. I found one website claiming that 75% of the power generated by solar panels is typically wasted, which is frankly laughable.

8. Don’t, either, be swayed by arguments that you need to order now before VAT rises to 20% in October. This is (unfortunately) true, but it doesn’t make the case for installing batteries any stronger.

In summary, for most existing solar panel owners, I don’t believe that installing batteries is likely to make economic sense at present. I don’t, therefore, intend to do so myself. If prices come down and the technology improves, however, the equation may change (and reducing or scrapping the VAT would help too). This is something I will continue to monitor, and if I change my mind in future I will of course let Pounds and Sense readers know!

So those are my thoughts, but what do YOU think? I’d love to hear from you, especially if you have solar batteries yourself or are actively considering them. Please feel free to post any comments or questions below.