My Short Break in Minehead

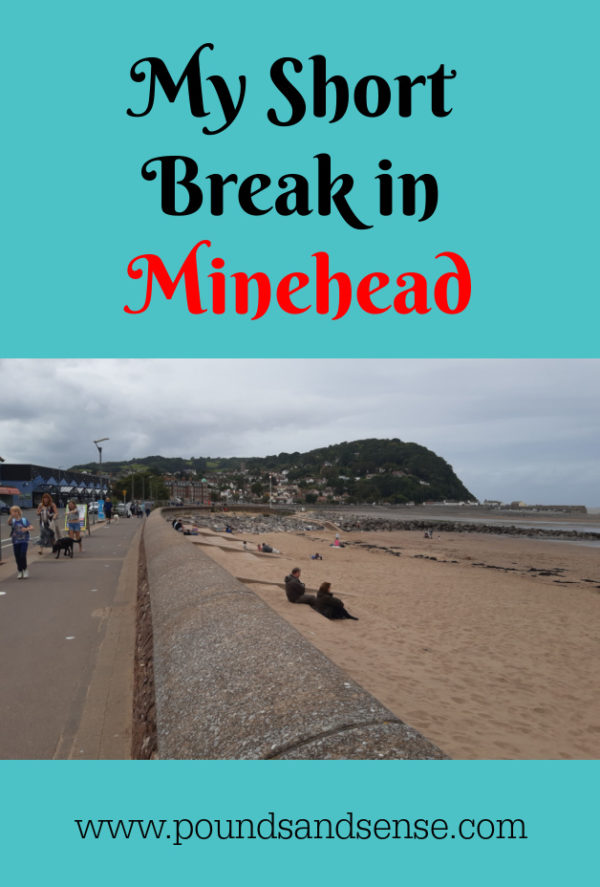

I recently enjoyed a three-night break in the North Somerset coastal town of Minehead.

It was actually my first visit to Minehead. Early this year, before the pandemic struck, I booked breaks in a few places I hadn’t been to before. Minehead was the only one I didn’t have to cancel 🙁

After some online research, I had booked a room at the Channel House Hotel. This is on Minehead’s North Hill (see cover photo), on the opposite side of the bay from the Butlins holiday camp. Here’s a map by courtesy of Google.

The Channel House Hotel had excellent reviews and a great location near the harbour. It had its own car park as well, which is always a plus with seaside hotels!

Here’s some more information about my stay…

The Hotel

The Channel House Hotel is a small country-house hotel with eight bedrooms. They don’t accommodate dogs or children under the age of 15.

I had Room 7, on the top floor. I had been hoping for a sea view, but due to a line of trees I couldn’t really see it from my room. I could at least hear the waves, though! The hotel is in a quiet, peaceful location, and I slept very well on all three nights.

As you would expect in these strange times, various anti-virus precautions were in place. I had my temperature checked on arrival, and hand sanitizer was available by the front door and on all the tables in the dining room.

I opted for breakfast and an evening meal, although you can book bed and breakfast only. Other dining options near the hotel appear limited, though, especially in these times of Covid.

There was a good choice of breakfast options for a small hotel. As well as the full English (which you can customize as you wish) you could also have Eggs Benedict in three different variations or smoked haddock with poached egg. You could also have a plate of mixed fruit, cereal and/or yogurt, plus the usual toast and hot drinks. I’m not sure what the normal arrangements for breakfast are, but obviously at present they can’t have a self-service buffet, so most meal options are brought to your table.

There is a choice of starters and main meals in the evenings, with guests asked to say what they would like after breakfast. Fair enough in my view, as there is obviously no point in the hotel preparing meals nobody wants! That applies especially at the moment with visitor numbers so low – partly due to the virus and partly (I understand) as a deliberate policy to help preserve social distancing. During my stay, there were never any more than six guests including me.

Evening meals are served at 7.00 pm, with pre-meal drinks in the small bar from 6.30. Although the latter is obviously optional, I did find this an enjoyable way of meeting and getting to know my fellow guests. There was one couple and all the others were solo ladies around my age or older. We all got along well. I enjoyed hearing what they had been doing during the day, as most of them knew the area better than I did.

The evening meals were very good. They comprised five courses: starter, main, dessert, cheese and biscuits, and coffee. That may sound a lot, but the portions were sensibly sized, so I didn’t feel too guilty!

Fish seems to be a speciality and I particularly enjoyed the sole I had on the first night. One thing that surprised me, though, was that the menu never included any vegetarian main courses. They do cater for veggies and those with special diets, so I’m sure if I’d asked I could have had something. For three nights I was perfectly happy with what was on offer. But as I eat vegetarian quite often at home, it might have been nice to have that option on the menu as well, some nights at any rate!

My twin-bedded room was more than adequate for my needs. It had a small (by modern standards) wall-mounted TV, but that was fine for a short visit. The WiFi worked well once I sorted out a bit of confusion over the password, and I was able to use it in my room as well as the communal areas. The bathroom was a good size and had a bath with a modern electric shower over it. My bed was comfortable and there was plenty of storage space. I was well looked after and had an enjoyable and relaxing stay.

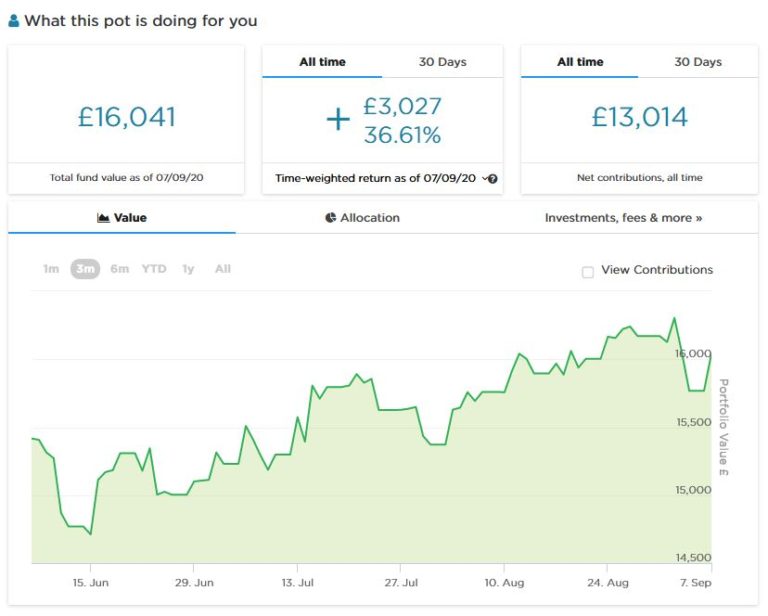

Financials

As Pounds and Sense is primarily a money blog, I should say a word about this.

I paid £360 for my three-night stay (including breakfasts and evening meals) at the Channel House Hotel, which I thought very reasonable. If I had chosen bed and breakfast only, the price would have been £285. As you may gather from this, the hotel charge a fixed price of £25 for their five-course evening meals.

You can check current prices and availability on the Hotels.com website. You can book this way (which I did) or directly with the hotel. The latter method may or may not work out cheaper.

Things to See and Do

Inevitably at the time of my visit a lot of places and attractions were either closed or not operating normally.

I was particularly disappointed that the West Somerset Railway – said to be the longest heritage railway in England – was not running. At the time of writing there is still no indication when it will reopen.

I was though able to visit Dunster Castle, which is owned by the National Trust. As a Trust member I was able to get free admission, but had to book a ticket in advance on the website. They are doing this to ensure that visitor numbers are controlled, to help maintain social distancing.

Dunster Castle goes back to at least Norman times, with an impressive medieval gatehouse and ruined tower providing a reminder of its long and sometimes turbulent history. The castle became a lavish country home during the 19th century for the Luttrell family, and the furnishings and decor are largely from that time. The castle is surrounded by a terraced garden displaying varieties of Mediterranean and subtropical plants. Below this is a riverside woodland garden leading to a historic working watermill (unfortunately closed at present).

Due to anti-virus measures, visitors have to follow a long and winding route through the gardens to get to the castle, so my top tip is to allow longer than you would expect to arrive at your allotted time. Bear in mind also that you will be expected to follow a similarly circuitous route afterwards to get back to the car park. This means there is a lot of walking before and after you see the castle itself. I was okay with that, but I suspect some older visitors might struggle.

Anyway I duly arrived at the castle entrance and, after giving a phone number for track-and-trace and using a hand sanitizer, was allowed to enter (wearing a face covering, of course). Only certain parts of the castle were open to visitors, not including the kitchens for some reason. On the plus side, though, with so few visitors there was plenty of room to see everything on view. Although entry is by timed ticket, once in you are allowed to stay for as long as you want (or at least for as long as you can stand wearing a face covering).

I spent around an hour in the castle, after which I was ready for some refreshments. I am not sure if the castle has a coffee shop normally but if so it was closed. They did though have a pop-up cafe in the gardens (you can just see this to the left of my photo above). I had a hot chocolate and a slice of coffee-and-walnut cake here, which I very much enjoyed even though it wasn’t exactly a healthy option!

Dunster Castle was the only formal visitor attraction I visited during my stay, and I do recommend it, so long as walking isn’t a problem for you.

In fact, I did a lot of walking throughout my break. That included along the seafront, from the harbour to the Butlins camp, and also up North Hill, which takes you to the edge of Exmoor. On the walk up North Hill, I stopped to admire the 16th century St Michael’s Church (also sadly closed).

Near the church is an area called Church Steps, where there are some beautiful thatched cottages.

I would like to show you the view across the bay from the top of North Hill, which I am told is quite spectacular. When I got to the viewing area, however, a closed and padlocked gate barred my way, with a forbidding warning notice about Covid-19. Having made the not-inconsiderable effort to walk up the hill (most people drive), this was pretty disappointing. I sat at the roadside for a few minutes collecting my thoughts before heading down again. That was probably the low point of the holiday!

On my last day in Minehead I took a short stroll to Blenheim Gardens, a well-tended and attractive public park. The cafe was closed as well, but I wandered down to the harbour and enjoyed a takeaway cream tea there 🙂

Closing Thoughts

Overall, I enjoyed my visit to Minehead, though obviously the fact that so many places were closed did spoil it a little. I had an enjoyable, relaxing time, with plenty of healthy fresh air and exercise (just as well in view of the cakes and five-course dinners!). I will hope to go back again when things are more normal.

As always, if you have any comments or questions about this post, please do leave them below.