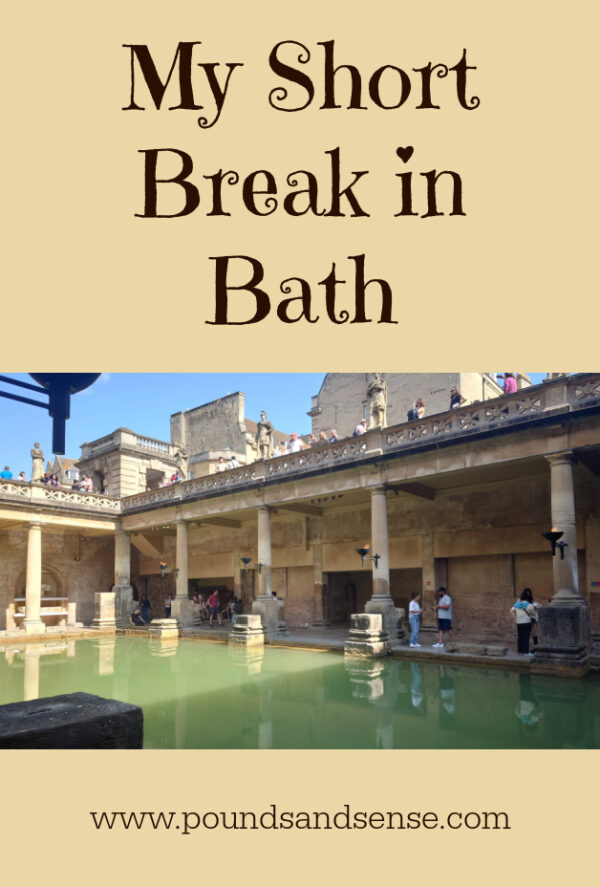

My Short Break in Bath

I recently returned from a three-day break in the historic city of Bath. It was the first time in over 30 years I’d been to Bath, so it’s fair to say I was approaching it with fresh eyes!

I stayed in a one-bedroom self-catering apartment in a large multi-occupied property called Elmbrook. This was about twenty minutes’ walk from the centre of Bath. I arranged it through Booking.com. I’ll say a bit more about the apartment below.

For those who don’t know, Bath is on the River Avon, about 12 miles from Bristol. Here is a map of the area from Google Maps…

Accommodation

As mentioned, I stayed in a self-catering apartment in a property called Elmbrook. This was on the Weston Road, a short but pleasant walk from the centre of Bath via the Royal Victoria Park and botanical gardens.

You can read more about where I stayed on this page of the Booking.com website (and see photos). One big attraction for me was that a reserved (and free) off-road parking space was available. In Bath – as in many popular tourist areas – finding somewhere to park can be tricky.

The apartment had a good-sized master bedroom with a comfortable double bed. It had a small but perfectly adequate bathroom with a modern power shower (though, somewhat ironically, no bath). The shower worked well and there was plenty of hot water.

The lounge was quite spacious. It was at the front of the house and had a small patio leading from it. Although I didn’t use the patio during my stay, the patio door provided a quick and convenient method for getting my luggage from and to the car! The lounge had a good-quality flat-screen TV and a DVD player with a small selection of DVDs.

The kitchen was at the back of the apartment and had all the facilities you would need or expect, including a modern electric oven and hob, microwave, toaster, fridge, sink, dishwasher, washing machine, and so forth.

The apartment had central heating on a thermostat, though as it was June I didn’t need this. It had free wifi which worked perfectly during my stay (not always the case in my experience). The location was quiet and peaceful, and I slept very well.

Finally I should say that communication from my Booking.com hosts (Nigel and Alison) was excellent. Nigel sent me detailed instructions about how to get there and how to get in (I used the key safe, though he offered to meet me in person if I preferred). They also left me a welcome letter and a basket of goodies, including a bottle of wine, muesli, milk, ground coffee, and so on. That was a kind gesture and obviously much appreciated.

Financials

As Pounds and Sense is primarily a money blog, I should say a few words about this.

I paid a total of £351 (including VAT) for my three-night visit, which works out to £117 a day. I thought that was very reasonable bearing in mind the high standard of the accommodation and the convenience of the location.

Obviously as it was self-catering no meals were included and neither was there a daily housekeeping visit. But on the plus side, I got a lot more space and facilities than I would have had at a hotel, and complete privacy throughout my stay. I’d have to admit that these days I prefer to go self-catering when possible, even if I do miss hotel breakfasts a bit!

Things to Do

I won’t give you a blow-by-blow account of everything I did on my visit. I will share some highlights and personal recommendations, though.

The first thing I did was book a ticket on the Hop On, Hop Off open-top sightseeing buses. My ticket cost me just under £20 after my over-60s discount and a small reduction for booking online. The most you will pay is £22.50, though.

A ticket allows you unlimited travel on two routes, the City Tour and the Skyline Tour. As you would expect, the City Tour takes you round all the main attractions in or near the centre, including the Royal Crescent, The Circus, Bath Abbey, the Roman Baths, Theatre Royal, and so on. You can listen to a commentary that tells you some interesting facts about Bath and its history. Earphones are provided for no extra charge, and you can choose from ten different languages (including English, naturally!). I found this a great way of getting my bearings.

The Skyline Tour takes you further afield, through some of the beautiful countryside surrounding Bath. It affords some wonderful views over the city, and you get to see a range of other interesting locations, including the university, the American museum and two National Trust parks and gardens. Again, an informative commentary is available. On both tours you can get on or off at any of the stops along the route. It’s worth noting that tickets are nominally valid for 24 hours, but I was told you can use them any time over a two-day period, which potentially makes them even better value. I definitely recommend doing this.

One ‘must see’ attraction in Bath is, of course, the stunning Roman Baths that gave the city its name (see cover photo). They aren’t especially cheap to visit (I paid the discounted price of £25 plus £5 for a guidebook), but are definitely worth it. Collect a free handset as you go in. You can then key in the code numbers displayed around the buildings to hear a commentary about what is on view in any particular area. There is loads to see, so I recommend allowing a couple of hours here at least.

Another top tip for visiting the Baths is to pre-book your ticket. I made the mistake of assuming I could just pay the admission fee and walk in, but that’s not generally the case. To manage numbers, visitors have to book a timed slot. I arrived at about midday but the earliest slot available then was 3.15. So I had to book using my mobile phone and come back later. It wasn’t a problem as there were plenty of other things I wanted to see and do – but if I was going again I’d definitely book my preferred day and time well in advance. Similar advice applies to other popular attractions in Bath, including the Jane Austen Centre and the No. 1 Royal Crescent Museum, incidentally.

Another place I especially enjoyed visiting was Bath Abbey. This church and one-time Benedictine monastery in the centre of Bath goes back to the 7th century, though it has been rebuilt several times since then. It is a fine example of Gothic Perpendicular architecture and particularly noted for its beautiful fan vaulting (see my photo below). There is an admission fee but it is relatively modest at about £6.50 (no over-60s discount, I’m afraid!).

I visited the Abbey with my old friend Jeff, who lives quite near Bath. We were lucky in that when we arrived a free tour of the Abbey was just about to begin, led by a knowledgeable voiunteer guide. We found this interesting and informative, especially when he explained about the Abbey’s new underfloor heating system, which is powered by heat from the spa water!

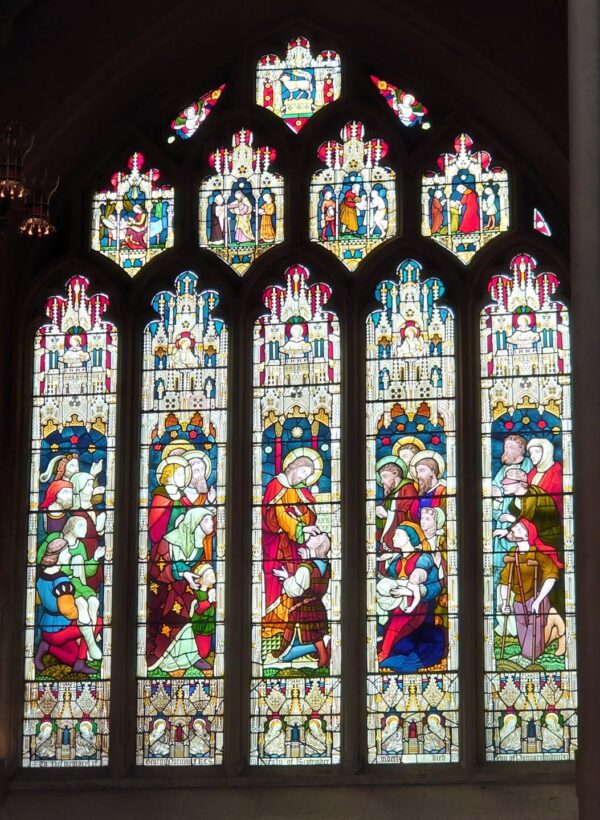

There are some lovely – though not especially old – stained glass windows in the Abbey, as the photo below shows. There are also some informative displays and exhibitions, along with a gift shop and (free) toilets.

Here are a few more quick hints and tips for visitors to Bath, based on my experience…

- You can download an excellent free map of Bath from this website. I printed this out and found it invaluable for finding my way around.

- Be sure to take a few 20p coins with you. Quite a few public conveniences require these 😮

- Keep a close eye on your speed if driving around (or towards) Bath. Many of the roads have a low 20 mph limit.

- There is also a low emission zone in Bath, though currently charges don’t apply to most private cars and motorbikes.

- You can’t actually swim in the Roman Baths, as this is set up as a tourist attraction. There are, though, a few places you can swim in spa water, most notably the Thermae Bath Spa. Be aware this costs a minimum of £40 for a two-hour session.

- As mentioned above, I highly recommend pre-booking visits to popular attractions. Not only will this guarantee admission at your preferred time, it may work out a bit cheaper as well.

- But don’t miss out, either, on admiring the stunning Georgian architecture of Bath, including the famous Royal Crescent and arguably even more impressive Circus. This is something you can do for free 🙂

- Something I didn’t do on this visit but would quite like to in future is a boat trip on the River Avon. There are various options here, including this one which combines a boat trip with a short walking tour.

Closing Thoughts

As you may gather, I enjoyed my short break in Bath, and am happy to recommend both the city and the accommodation where I stayed for a short break.

Bath is quite compact but there is plenty to see and do. As well as the historical sites, there are lots of charming cafes and coffee shops, and some highly regarded pubs and restaurants. But it can also be a great place to chill out, with lovely green spaces such as the Royal Victoria Park and adjacent botanical gardens (both free to visit). I shall definitely be returning again before too long!

As always, if you have any comments or questions about this post, please do leave them below. Also, if you have visited Bath yourself and have any additional tips or recommendations, I would love to hear them!