Make Money From Precious Metal Mining With the Raptor IFISA

On Pounds and Sense I often talk about the importance of having a diversified investment strategy. And the investment opportunity I am spotlighting today will certainly help you towards achieving that aim!

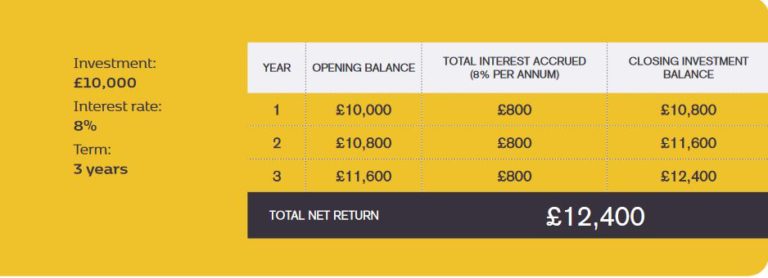

Raptor is a platform that provides ordinary individuals with the opportunity to invest in the production of gold and precious metal mining. The product on offer is a three-year mini-bond with a tax-free IFISA wrapping. Raptor are currently offering a return of 8 percent per year on a minimum £2,000 investment.

What Is An IFISA?

For those who may not know, IFISA is short for Innovative Finance ISA. IFISAs allow anyone to invest tax-free in authorized ‘innovative finance’ platforms, including P2P lending and mini-bonds.

You can put any amount into an IFISA up to your annual ISA allowance. In the current 2018/19 tax year this is £20,000, which can be divided however you choose between a cash ISA, a stocks and shares ISA and an IFISA. So, for example, you could invest £10,000 in a cash ISA, £6,000 in a stocks and shares ISA and £4,000 in an IFISA. The ISA allowance for 2019/20 will be £20,000 as well, though after that it could change.

- Note that under current rules you are only allowed to invest new money in one of each type of ISA in a tax year. It is though generally possible to transfer money from one type of ISA to another without it affecting your annual entitlement (although there may be platform fees to pay).

How Is Your Money Invested?

The money raised from Raptor IFISA investors is used to provide ‘Stream and Royalty’ finance for mining companies. This is explained in detail in the Raptor IFISA brochure, but briefly Raptor’s investment arm (Raptor Capital International, or RCI for short) makes payments to carefully selected development-stage mining companies to purchase part of their future production at a price below the market level.

The mining company therefore receives much-needed capital through immediately monetizing part of its future production, and investors get the opportunity to make a good return on their investment. Stream and Royalty Finance is still relatively new, and with many high-quality mining projects requiring financing there is an opportunity for investors to capitalize on this.

What Are The Returns?

The Raptor IFISA pays 8% interest per year for the three-year term of each bond, with a minimum investment of £2,000. As it’s an IFISA, all profits are paid without any deductions for tax. There is also no charge for investing in the Raptor IFISA.

Returns are paid as simple interest, as shown in the diagram below, which has been copied from the Raptor IFISA brochure. All capital and interest is returned at the end of the three-year term (or earlier if the bond is repurchased/redeemed by Raptor before this point).

What Are The Risks?

All UK IFISA providers have to be authorized by the Financial Conduct Authority (FCA) and HMRC. This doesn’t in itself protect investors against the failure of a platform, however. While savers with UK banks and building societies are covered by the government’s Financial Services Compensation Scheme (FSCS), which guarantees to reimburse up to £85,000 of losses, this does not apply to IFISA platforms (or stocks and shares ISAs, for that matter).

IFISA investors don’t therefore enjoy the same level of protection in the UK as bank savers. This is, of course, a major reason why the returns on offer are significantly higher. It’s therefore important to be aware of the risks and ensure you are comfortable with them before investing this way. It’s also important to invest across a range of asset classes and sectors, and not make the mistake of putting all your eggs in one investment basket.

In addition, the Raptor IFISA is not a liquid investment. Your money will normally be tied up for three years. Raptor say they will assist investors if they want to sell or transfer their bonds to another investor, but there is no guarantee that a buyer will be found. This opportunity is therefore not suitable for funds you might need back quickly and should be regarded as a medium- to long-term investment.

Finally, there is of course a risk that the underlying mining investments will not pay off. However, Raptor and RCI’s Advisory Committee say they will undertake extensive due diligence and engage third-party providers to assist in determining whether or not projects meet and qualify for financing in accordance with set criteria, for example:

- There has to be at least a 200,000 ounce gold resource (or gold equivalent ounces).

- Uncomplicated metallurgy, allowing simple, conventional, traditional extraction.

- Payback of initial capital and interest within three years of production.

- Access to mining company financial records.

- Allow an RCI agent on site to oversee operations.

With all that said and done, there is no guarantee that you will receive the advertised returns. It is important that you understand and are comfortable with the risks involved.

Summing Up

If you are looking for a home for some of your money that can offer better interest rates than banks and building societies – and won’t incur any tax charges – the Raptor IFISA is worth considering.

As well as higher interest rates, Raptor bonds can add diversity to your saving and investment portfolio, helping you ride out peaks and troughs in the financial markets. The bonds provide an opportunity to profit directly from the returns to be made in precious metal mining, a sector under-represented in many people’s portfolios. The relatively low minimum investment of £2,000 and absence of any charges are further attractions. Just be sure that you are aware of the risks involved, and that you invest only as part of a diversified portfolio.

For more information, please visit the Raptor IFISA website. You can find out more about the investment opportunity there, and also download an informative 14-page brochure.

Disclosure: this is a sponsored post on behalf of the Raptor IFISA. All investments carry a risk of loss. Be sure to do your own ‘due diligence’ before investing, and speak to a qualified professional financial adviser if in any doubt before proceeding.

If you have any comments or questions about this post, as always, feel free to post them below.