What Is the Difference Between Income and Accumulation Funds?

If you invest in funds rather than individual stocks and shares, you’ll almost certainly know that in many cases you can choose between two options, income or accumulation. Today I thought I’d explain what this difference is and share a few thoughts on the subject. I will be referring to my own experiences in this regard.

But to start by answering the question in the title, the difference between income and accumulation Funds is basically as follows:

Income Funds pay any income generated by your investments as, well, income. The money will appear in your account ready for you to withdraw (or reinvest). Or it may simply be paid directly into your bank account if you prefer.

Accumulation Funds, on the other hand, use any income generated by your investments to buy more units in the fund concerned. Your holding in an accumulation fund (and its value) should therefore build over time. But you won’t typically receive any income from the fund.

You might therefore think that if you want to draw an income from your investment, an income fund is the way to go. In practice it’s not as simple as that, though. For one thing, if you want to withdraw money from an accumulation fund, you always have the option to sell some of your holding, and there can be significant advantages to proceeding this way.

I will discuss this in more detail below, focusing on my personal pension as an example. Of course, everyone’s circumstances are different, so the decisions I took (and am still taking) may not be right for you. But I hope it will give you food for thought.

Why My SIPP is Mostly in Accumulation Funds

Regular readers will know that for some years I saved for my pension in the form of a SIPP (Self Invested Personal Pension). I use the Bestinvest platform for this and have always researched and chosen my investments myself. My SIPP currently has 14 funds in it. You can see a screen capture below.

As you can see, most of these are accumulation (Acc) funds with a couple of income (Inc) funds. While I was building my pot it seemed sensible to put most of my money into accumulation funds.

- I am not by any stretch claiming that this is a ‘model portfolio’ that anyone else should emulate. I picked these funds based on recommendations I read in the press (and online) at the time, and there may well be better options now. I aimed to diversify as broadly as possible across different market sectors, geographical areas, investment types, and so on.

I put my SIPP into drawdown three years ago and now take £200 a month from it. I did consider switching to income funds at that time, but after careful thought (and research) decided against this.

The small number of income funds in my portfolio don’t typically generate enough to cover my monthly withdrawals. So each month I log in to my online dashboard and sell the necessary amount from whatever fund I pick that month. I must admit there is nothing very scientific about this. I typically just sell from funds I already have large holdings in.

Obviously having to do this every month is a minor hassle. However, in my view it has advantages as well. If you hold mainly income funds, the money they generate will vary from month to month. Sometimes there might not be enough to cover your monthly drawings, meaning you would still have to sell some funds anyway. Conversely, there might be months when more income is generated than you need, so you would end up with ‘spare’ money sitting in your account and not working for you.

Overall, then, I like having my SIPP money in accumulation funds because each month I can sell enough to cover my drawings that month, no more and no less. All the rest of the income that is generated by my accumulation funds is automatically reinvested.

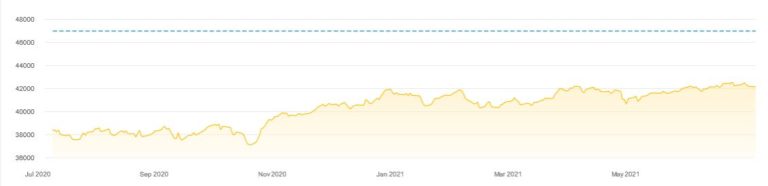

Interestingly, despite the fact that my annual withdrawals amount to almost 6% of the value of my portfolio, the overall value of my SIPP has continued to grow since I put it into drawdown three years ago (see graph below). I am not convinced that would be the case if I had switched to income funds across the board.

- The standard advice is that you should withdraw no more than 4% of your portfolio each year to try to preserve its value. I have actually been taking nearly 50% more than that in the middle of a pandemic, and yet the overall value has still gone up by almost £4,000 in the last year alone. Obviously past performance is no guarantee of what may happen in future, but it is certainly food for thought.

Further Thoughts

Of course, pension funds aren’t the only sort of investment where this applies. You could, for example, be investing in a tax-free ISA, and again face the choice between income and accumulation funds. If you are aiming to build a pot, there is (of course) a strong argument for going with accumulation funds. But even if you want an income, the arguments above on behalf of accumulation funds still apply.

One further consideration is tax. If you are investing via a SIPP or ISA (or some other tax-efficient wrapper) this obviously won’t be an issue. But if you’re investing outside one of these, you do need to be aware of the tax implications.

With an income fund it’s fairly straightforward. The money you receive will count as taxable income (or taxable dividends in some cases) and be taxed accordingly.

With an accumulation fund, it’s more complicated. The income that is rolled up and reinvested is known as a ‘notional distribution’ and you will still be liable to pay tax on it at the appropriate time. This is explained in more detail in this excellent article from Shares Magazine.

As I say, investing outside a tax-efficient wrapper can be complicated, especially with accumulation funds. I would therefore recommend taking professional advice if you find yourself in this position. Ideally, though, ensure all your money is invested within a tax-free wrapper (SIPP, ISA, etc.). You won’t then have to worry about tax at all!

I hope you have found this post of interest. Whether you agree or disagree with my approach, I’d love to hear from you. Please leave any comments or questions below as usual.

Disclaimer: I am not a qualified financial adviser and nothing in this article should be construed as personal financial advice. All investment carries a risk of loss. You should always do your own ‘due diligence’ before investing, and seek professional advice if in any doubt before proceeding.

July 28, 2021 @ 9:23 pm

This is such an interesting read, I always learn something new when I come here and I wish I had more time to research how to best invest my money.

July 29, 2021 @ 7:57 am

Thanks, Michelle. Glad you found it interesting.

July 29, 2021 @ 9:47 am

I didn’t actually know the difference between the too. I have some S&S ISA’s which are accumulatio funds, and then I have some individual shares I’ve bought which I also believe are accumulation funds, but I’m not actually that sure as they’re not worth that much x

July 29, 2021 @ 10:38 am

Thanks, Rhian. It can be confusing, can’t it? Some companies do issue accumulating shares, where instead of paying dividends they reward shareholders with additional stock. In this post I am mainly talking about funds, though.